How to Calculate Principal Paid on a Mortgage – Formula, Examples and Calculator

Buying a home is often the biggest financial commitment of a lifetime, yet the mechanics of how that debt is actually paid off remain a mystery to many. You sign the papers, move in, and start making monthly payments. For the first few years, you diligently send money to the bank, but when you look at your loan statement, the balance seems to have barely budged. It can be frustrating and even a little demoralizing.

This happens because of how mortgage amortization works. A huge chunk of your money in the beginning isn’t buying your house; it’s renting the money to buy the house (interest). Understanding this split is crucial. It changes the way you view your debt and empowers you to take control of your financial future. You aren’t just making payments; you are building equity, slowly at first, and then much faster.

To truly understand your position, you need to know how to calculate principal paid on a mortgage. Knowing this number tells you exactly how much of the home you actually own versus how much still belongs to the bank. Whether you are five years into a 30-year term or planning to make a lump sum payment, seeing the “principal paid” figure grow is the best motivation to keep going.

If you prefer not to work through the manual calculations, you can use the principal paid calculator below to see the results instantly.

Principal Paid Calculator

Loan Details

| Year | Principal Paid | Interest Paid | Balance (End of Year) |

|---|

- How to Calculate Principal Paid on a Mortgage – Formula, Examples and Calculator

- What Is Principal Paid on a Mortgage?

- Principal vs Interest in a Mortgage Payment

- Why Calculating Principal Paid Matters

- Mortgage Principal Calculation Basics

- Step-by-Step: How to Calculate Principal Paid on a Mortgage

- Example Calculations

- How Extra Payments Affect Principal Paid

- How to Use Our Principal Paid Calculator

- How to Interpret the Results

- Common Mistakes When Calculating Principal Paid

- Principal Paid vs Remaining Balance

- Principal Paid at Different Stages of a Mortgage

- Frequently Asked Questions (FAQ)

- Summary

- Related Mortgage Calculations You May Find Helpful

- Disclaimer

What Is Principal Paid on a Mortgage?

In simple terms, “principal” is the amount of money you originally borrowed to buy your home. If you bought a house for $350,000 and put $50,000 down, your starting principal is $300,000.

“Principal paid” is the portion of that original $300,000 that you have paid back to the lender. It represents the transition of ownership from the bank to you. Every dollar of principal paid is a dollar of debt erased forever.

It is important to distinguish this from your “total amount paid.” If you have sent the bank $20,000 in payments over a year, you might assume you have paid off $20,000 of your debt. Unfortunately, that is rarely the case. In the early stages of a loan, that $20,000 payment might only result in $5,000 of principal paid on mortgage debt, while the remaining $15,000 vanishes into interest costs.

Principal vs Interest in a Mortgage Payment

To understand how to calculate principal paid on a mortgage, you first have to understand the anatomy of your monthly payment. For a standard fixed-rate mortgage, your total monthly payment (often called P&I) usually stays the same for the life of the loan. However, what happens inside that payment changes every single month.

The Seesaw Effect

Think of your payment as a seesaw. On one side, you have interest; on the other, you have principal.

- At the start: The interest side is heavy. The bank calculates interest based on your total outstanding balance. Since your balance is highest at the start, the interest charge is highest.

- Over time: As you chip away at the balance, the interest charge (which is a percentage of that balance) drops slightly.

- The Result: Since your total payment is fixed, every dollar saved on interest automatically rolls over to pay down more principal.

This is why the principal paid on mortgage balances accelerates over time. You don’t have to change anything; the math naturally shifts in your favor the longer you hold the loan.

Why Calculating Principal Paid Matters

Why go through the trouble to calculate principal paid on mortgage progress? Why not just look at the remaining balance? Digging into the principal numbers offers several practical benefits:

- Tracks Real Ownership: The remaining balance tells you what you owe, but the principal paid tells you what you own. It is a scorecard of your equity.

- Validates Extra Payments: If you decide to pay an extra $100 a month, looking at the total balance might not feel rewarding. But if you calculate the principal specifically, you see that 100% of that extra money went to ownership.

- Explains the “Slow” Years: When you see the breakdown, you stop feeling cheated by the bank and start understanding the math. It helps you stay patient during the early years when progress feels slow.

- Strategic Planning: Knowing how much principal is paid on mortgage loans helps you decide when you might have enough equity to remove Private Mortgage Insurance (PMI) or refinance for a better rate.

Mortgage Principal Calculation Basics

Before we get to the formulas, it helps to understand how mortgage payments work. Most mortgages follow an amortization schedule, which is simply a table showing how much of each payment goes toward interest and how much goes toward principal.

The calculation relies on three main variables:

- Loan Balance – The amount you owe at the start of the month

- Interest Rate – The annual percentage rate agreed in the loan

- Monthly Payment – The fixed amount you pay each month

The principal portion is not calculated directly. The lender calculates interest first, because interest is the cost of borrowing the money. Whatever remains from your payment after the interest is covered becomes the principal paid.

Principal Paid Formula

When you want to calculate principal paid on a mortgage manually, you must follow a step-by-step logic. There is no simple, one-line formula that instantly shows the total principal paid over several years without calculating each month individually.

For any single month, the core relationship is:

Principal Paid = Monthly Payment − Monthly Interest

Where:

Monthly Interest = Current Loan Balance × (Annual Interest Rate ÷ 100 ÷ 12)

The Cumulative Logic

To find how much principal you have paid over a longer period (such as 3 years), you must calculate the principal for Month 1, subtract it from the loan balance to get the new balance for Month 2, then repeat the same process each month.

Total principal paid is simply the sum of all monthly principal portions over that time period.

Note: You cannot subtract the interest rate directly from the payment amount. Interest must always be applied to the remaining loan balance, which changes every month. This is why a principal paid calculator is often essential for long-term calculations.

Step-by-Step: How to Calculate Principal Paid on a Mortgage

If you want to understand how principal payments work, you can calculate them manually with a basic calculator. Below is the step-by-step process for calculating the principal paid for one month.

The Scenario

- Current Loan Balance: $200,000

- Interest Rate: 4.5%

- Loan term : 30 years

- Monthly Payment: $1,013.37

Step 1: Calculate Monthly Interest

First, convert the annual interest rate into decimal form.

4.5% = 0.045

Now calculate the monthly interest using the current loan balance:

Monthly Interest = 200,000 × 0.045 ÷ 12

Monthly Interest = 750.00

This $750.00 is the interest charged for the current month.

Step 2: Subtract Interest From the Payment

Next, subtract the interest from your total monthly payment:

Principal Paid = 1,013.37 − 750.00

Principal Paid = 263.37

This means $263.37 of your payment goes toward reducing the loan balance.

Step 3: Add Any Extra Payments

If you made an extra payment of $50 during the month, it goes entirely toward principal because interest has already been covered:

Total Principal Paid = 263.37 + 50.00

Total Principal Paid = 313.37

Step 4: Reduce the Loan Balance

Now subtract the total principal paid from the starting balance:

New Loan Balance = 200,000 − 313.37

New Loan Balance = 199,686.63

This becomes the starting balance for the next month.

Step 5: Repeat the Process

For the following month, repeat the same steps using the new balance of $199,686.63. Since the balance is lower, the interest will also be slightly lower (about $748.82), which means a slightly higher portion of the payment will go toward principal (about $264.55).

As you can see, repeating this process manually for dozens of months—or several years—quickly becomes tedious. This is why most homeowners rely on a principal paid calculator to track progress and run long-term scenarios accurately.

Example Calculations

To illustrate how mortgage principal calculation works in the real world, let’s look at three scenarios. These show how the numbers shift over time and with different strategies.

Example 1: The “Slow Start” (First Year Reality)

- Scenario: You take out a standard $300,000 loan for 30 years at 6.5% interest.

- What Happens: In the first year, you will pay a total of about $22,754 to the bank.

- The Breakdown:

- Interest Paid: $19,401

- Principal Paid: $3,353

- Interpretation: Only about 15% of your money actually reduced your debt in Year 1. This is normal, but it explains why your balance drops so slowly at first.

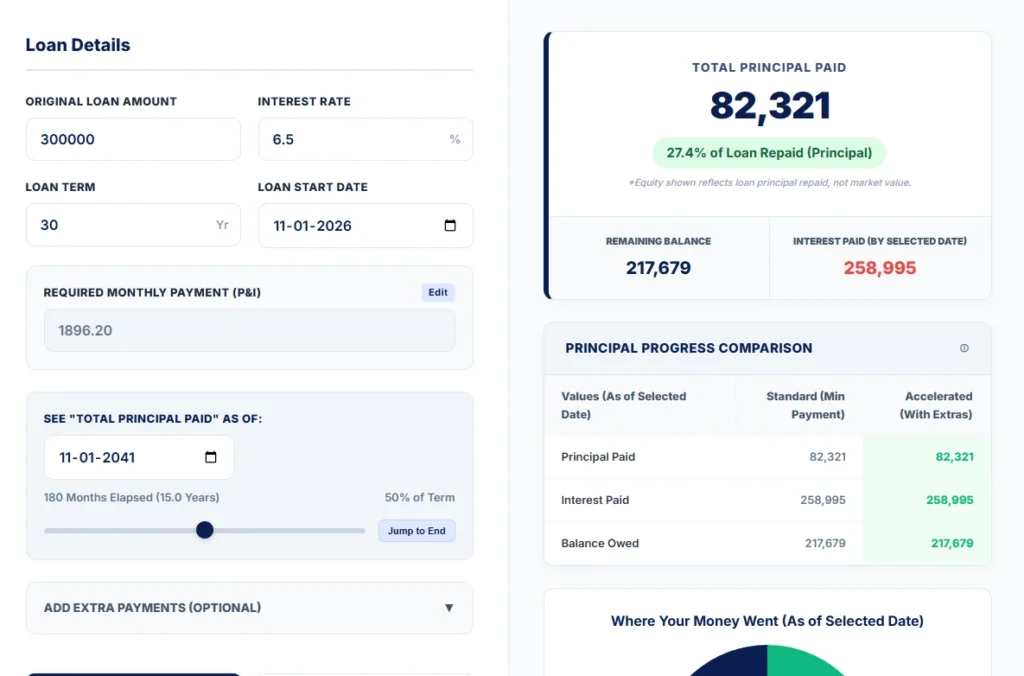

Example 2: The “Tipping Point” (Year 15 Milestone)

- Scenario: Same loan, but you have now been paying consistently for 15 years.

- What Happens: You have reached the halfway mark of your loan term.

- The Breakdown (Cumulative Totals by Year 15):

- Total Interest Paid: $258,995

- Total Principal Paid: $82,321

- Interpretation: Even after 15 years of payments, you have paid significantly more in interest than principal. However, the tide is turning—your remaining balance is now low enough that future payments will hit the principal much harder.

Example 3: The Power of Extra Cash

- Scenario: You decide to pay an extra $200 a month starting from day one.

- The Result: By the end of Year 5, you will have paid off $33,302 of principal, compared to just $19,160 if you had only made the minimum payments.

- Interpretation: That extra $200 didn’t just add up linearly; it saved you interest, which then compounded to pay off even more principal. You are now years ahead of schedule.

How Extra Payments Affect Principal Paid

One of the most common questions is tocalculate principal paid on a mortgage when you make extra payments. This is where the magic of compound savings happens.

Because mortgage interest is calculated on the outstanding balance, every extra dollar you pay reduces that balance immediately.

- Direct Reduction: If you pay an extra $500, your balance drops by exactly $500.

- Future Savings: Next month, the bank calculates interest on a balance that is $500 lower. This saves you roughly $2–$3 in interest for that month.

- Compounding: That saved $2–$3 remains in your payment and pays off more principal. Over 30 years, this snowball effect is massive.

You can make extra payments in several ways:

- Monthly Extras: Adding a small amount to every bill.

- Lump Sums: Using a work bonus or tax refund to make a large one-time reduction.

- Bi-weekly Payments: Paying half your monthly payment every two weeks results in one full extra payment per year, purely applied to the principal.

Our principal paid calculator handles all these scenarios to show you exactly how much time and interest you save.

How to Use Our Principal Paid Calculator

We have designed a custom tool to help you calculate how much principal i have paid and project your future progress. You don’t need to be a math whiz to use it. Here is a guide to the features you will find in the calculator.

1. Enter Loan Details

Start by inputting your basic mortgage information in the “Loan Details” section on the left:

- Original Loan Amount: The starting figure of your debt.

- Interest Rate: Your annual fixed rate.

- Loan Term: Usually 15 or 30 years.

- Start Date: When you made your first payment.

2. Set the “Snapshot” Date

This is a unique feature. Look for the “See Total Principal Paid As Of” date picker.

- The calculator will tell you exactly how much principal you have paid from the start date up to this specific target date.

- You can use the slider to quickly jump forward or backward in time to see how your equity grows.

3. Add Extra Payments (Optional)

Click the accordion menu to reveal advanced options. You can toggle “Bi-weekly Payments” or add specific lump sums (e.g., “$5,000 paid on Dec 2025”). The calculator immediately updates the “Total Principal Paid” to reflect these strategies.

4. Review the Results

On the right side (or bottom on mobile), you will see:

- Total Principal Paid: The big number you are looking for.

- Remaining Balance: What is left to pay.

- Comparison Table: A side-by-side look at “Standard” vs. “Accelerated” progress, showing you exactly how much your extra payments have boosted your ownership.

How to Interpret the Results

Once you use the principal paid calculator, you might see numbers that surprise you. Here is how to make sense of them.

Low Principal Paid Early On

If you are in the first 5–7 years of a 30-year mortgage, don’t panic if your principal paid on mortgage is lower than you expected. This is normal. The amortization curve is steep at the start. It doesn’t mean you are doing something wrong; it just means the loan is young.

Accelerating Principal Later

If you select a date 20 years into the future, you will notice the principal paid jumps massively. This is the “back-half” benefit. As your interest costs plummet, your principal payment skyrockets. This is why financial experts often advise against resetting your loan (refinancing) when you are far into your term—you reset the clock back to the high-interest phase.

High Principal Share

If you see that your principal paid is significantly higher than the standard projection, it is likely because you utilized the extra payments feature. This confirms that your strategy is working, and you are building equity faster than the bank’s schedule.

Common Mistakes When Calculating Principal Paid

When homeowners try to calculate principal paid on mortgage debt manually, they often trip up on a few common errors.

- Confusing Total Payment with Principal: Never assume your full $1,500 check reduces your debt by $1,500. Usually, only a fraction of it does.

- Ignoring the Interest Portion: You cannot simply take (Loan Amount ÷ Months) to find the monthly principal. That only works for 0% interest loans, which don’t exist in the mortgage world.

- Forgetting Extra Payments: If you paid an extra $1,000 three years ago, you must account for that. It permanently lowered your balance and changed the interest calculation for every single month that followed.

- Static Math on Dynamic Loans: Assuming the principal portion is the same every month is incorrect. It changes every 30 days.

Principal Paid vs Remaining Balance

These two terms are often used in the same breath, but they are opposites.

- Principal Paid: The history of your success. It is the pile of money you have successfully moved from the “bank’s side” to “your side.”

- Remaining Balance: The future obligation. It is what you still have to tackle.

Mathematically, they are connected:

Original Loan Amount – Principal Paid = Remaining Balance

However, when you use a principal paid calculator, you are often looking for motivation (how far I’ve come), whereas checking your balance is usually a source of stress (how far I have to go). Focusing on the mortgage principal paid can be a psychological boost.

Principal Paid at Different Stages of a Mortgage

The amount of mortgage principal paid changes drastically depending on the “season” of your loan. Even with the exact same interest rate and payment, a dollar paid in Year 1 behaves differently than a dollar paid in Year 25.

Comparison Table: Principal Paid Over Time

| Mortgage Stage | Typical Interest Share | Typical Principal Share | What This Means |

| Early Years (0–5) | Very High | Very Low | Your payments are mainly covering the cost of borrowing. Equity builds slowly. |

| Mid-Term (6–15) | Balanced | Moderate | The scales start to tip. You see noticeable drops in the balance every year. |

| Later Years (16–30) | Low | High | You are now paying off the house rapidly. Most of your check stays in your pocket as equity. |

Principal Paid vs Mortgage Balance Over Time

To further clarify the relationship between these two critical figures, let’s compare them directly. This helps distinguish between tracking progress and tracking debt.

Comparison Table: Principal Paid vs Remaining Balance

| Aspect | Principal Paid | Remaining Balance |

| What it shows | Amount of loan already repaid | Amount still owed |

| Direction over time | Increases ↗ | Decreases ↘ |

| Reaches zero | No (Reaches full loan amount) | Yes (When loan is paid off) |

| Used for | Measuring ownership progress | Knowing payoff amount |

| Calculated how | Sum of all principal portions | Original loan minus principal paid |

Frequently Asked Questions (FAQ)

Summary

Understanding how to calculate principal paid on a mortgage is the key to mastering your home loan. It transforms a boring monthly bill into a strategic financial tool.

- Principal Paid is the portion of the loan you have successfully eliminated.

- Interest eats up the majority of payments in the early years but fades over time.

- Extra Payments are powerful because they skip the interest cycle and add 100% to your principal paid column.

- Tools Matter: While the formula is simple (Payment – Interest), the changing balance makes a principal paid calculator essential for long-term planning.

By tracking this number, you stop guessing and start knowing exactly when you will be debt-free. Use the calculator provided above to run your own numbers and see how much of your home you truly own today.

Related Mortgage Calculations You May Find Helpful

Once you understand how principal paid is calculated, it becomes easier to explore other important mortgage calculations that build on the same logic:

- How to Calculate Total Interest Paid on a Mortgage – See how principal and interest work together over the full loan term and why early payments feel interest-heavy.

- How to Calculate Paying Off a Mortgage Early – Understand how extra payments change principal reduction and shorten the loan timeline.

- How to Pay Off a Mortgage in a Fixed Number of Years – Learn how higher monthly payments directly increase principal paid and reduce total interest.

- How to Calculate Remaining Loan Balance – Track how much principal is still unpaid at any point during the loan.

Each of these topics uses the same payment breakdown explained in this guide, helping you analyze your mortgage from different angles without changing the underlying math.

Disclaimer

This article and the attached calculator are for educational and informational purposes only. They do not constitute financial advice. Mortgage calculations can vary based on lender practices, compounding frequency, and specific loan terms. Please consult a financial advisor or your lender for precise figures regarding your mortgage.