How to Calculate Net Income | Paycheck Net Income Calculator & Guide

You just got a job offer. The salary is $75,000 a year. You grab your phone calculator, divide by 12, and think, “Great! I’ll have $6,250 to spend every month.”

Then, the first direct deposit hits your bank account. It’s $4,600.

Panic sets in. Where did the rest of the money go? Did payroll make a mistake? Probably not. You just met the difference between Gross Income and Net Income.

If you live and work in the United States, figuring out exactly how much money will land in your pocket is more complicated than just looking at your hourly rate or annual salary. Between FICA taxes, federal brackets, state levies, and health insurance premiums, your paycheck undergoes a lot of “surgery” before it reaches you.

In this guide, we will walk you through exactly how to calculate net income, the formulas you need, and how to use our calculator to get an accurate number.

Want to skip the manual math? You can use the free calculator below to determine your 2025 take-home pay instantly. If you prefer to learn how the formula works step-by-step, scroll down to continue reading.

Paycheck Net Income Calculator

Net Income Calculator

provided by howtocalc.com

Generated on

Annual Net Income

- How to Calculate Net Income | Paycheck Net Income Calculator & Guide

- What Is Net Income?

- Net Income Formula

- Step-by-Step Guide: How to Calculate Net Income From Your Paycheck (Using a $120,000 Example)

- Examples — Personal Net Income (US)

- Why Net Income Matters

- Net Income vs Gross Income

- Common Mistakes When Calculating Net Income

- Net Income Calculator (How Ours Works)

- FAQs

- Disclaimer

What Is Net Income?

In the simplest terms, Net Income is the money you actually get to keep. It is the specific dollar amount that lands in your checking account on payday.

You might hear people refer to this by several names, but they all mean the same thing:

- Take-home pay

- Net Pay

- Disposable Income

Think of your salary as a block of ice. As you carry it from your employer to your house (your bank account), the heat melts it down. The heat represents US taxes, insurance premiums, and retirement contributions. What is left in the bucket when you arrive home is your Net Income.

For US employees, knowing how to find net income is vital because you cannot pay rent or buy groceries with “Gross Pay.” Your landlord doesn’t care that you make $80,000 “on paper” if you only take home $58,000 after paycheck deductions.

The Big Disconnect

The reason this is so confusing is that we negotiate salaries in Gross terms (“I make $30 an hour” or “$60k a year”), but we live our lives in Net terms (“My rent is $1,500 a month”). As Investopedia notes, while gross income is your starting point, net income is the true measure of your spending power. Learning how to calculate net income bridges that gap so you can build a budget that actually works.

Net Income Formula

If you are looking for the quick math on how do i calculate net income, here is the formula. While it looks simple, the complexity is hidden inside the “Taxes” and “Deductions” parts.

The Equation

Net Income = Gross Pay − (Pre-Tax Deductions + Taxes + Post-Tax Deductions)

The Components

To use this formula, you need to know what each variable means in the US payroll system:

- Gross Pay: This is the starting number. It is your total earnings before a single penny is taken out. If you are salaried, it’s your annual salary divided by pay periods. If you are hourly, it is Hours Worked × Hourly Rate.

- Pre-Tax Deductions: These are “good” deductions because they lower the amount of tax you pay. Common examples include 401(k) contributions and health insurance premiums (if paid through a Section 125 cafeteria plan).

- Taxes: The mandatory government cuts.

- Federal Income Tax: Progressive tax based on IRS brackets.

- FICA: Social Security (6.2%) and Medicare (1.45%).

- State & Local Tax: Varies depending on where you live (e.g., California has high tax; Texas has zero state income tax).

- Post-Tax Deductions: Money taken out after taxes are calculated. This includes Roth 401(k) contributions, wage garnishments, or union dues.

Step-by-Step Guide: How to Calculate Net Income From Your Paycheck (Using a $120,000 Example)

Understanding how your income turns into your actual take-home pay becomes much simpler when you break it into clear steps.

Below is a professionally structured guide that explains the entire process using a real-world example:

- Annual salary: $120,000

- Filing status: Single

- 401(k) contribution: 5%

- Health insurance: $300 per month (pre-tax)

- State tax: 4.5% flat rate

You can follow the exact same method for your own numbers.

Step 1: Determine Your Gross Pay Per Period

Your gross pay is your income before any taxes or deductions.

Example (using a $120,000 salary)

- Monthly gross pay:

120,000 ÷ 12 = 10,000 - Bi-weekly gross pay (26 paychecks):

120,000 ÷ 26 = 4,615.38 - Weekly gross pay (52 paychecks):

120,000 ÷ 52 = 2,307.69

If you are hourly:

- Regular pay = hourly rate × hours worked

Overtime (over 40 hours/week) = 1.5 × hourly rate

Step 2: Subtract Pre-Tax Deductions

Pre-tax deductions reduce the amount of income subject to federal income tax.

Common pre-tax deductions include 401(k) contributions and medical/dental premiums.

Example calculations

- 401(k):

120,000 × 0.05 = 6,000 - Health insurance (pre-tax):

300 × 12 = 3,600 - Total pre-tax deductions:

6,000 + 3,600 = 9,600 - Adjusted income (before standard deduction):

120,000 – 9,600 = 110,400

This amount will be used to calculate federal income tax before applying the standard deduction.

Step 3: Calculate FICA Taxes (Social Security & Medicare)

FICA rules differ from federal tax rules:

- 401(k) contributions do NOT reduce FICA.

- Health insurance under Section 125 does reduce FICA.

Therefore, FICA is based on FICA-taxable wages, not your federal taxable income.

FICA-taxable wages

120,000 – 3,600 = 116,400

Social Security (6.2%)

116,400 × 0.062 = 7,216.80

Medicare (1.45%)

116,400 × 0.0145 = 1,687.80

Total FICA taxes

7,216.80 + 1,687.80 = 8,904.60

Step 4: Calculate Federal Income Tax

The U.S. uses a progressive tax system, where different portions of income fall into different tax brackets.

Step A: Subtract the standard deduction

2025 standard deduction for Single filers: 15,000

110,400 – 15,000 = 95,400

(Federal taxable income)

Step B: Apply the 2025 federal tax brackets (Single)

- 10% on income up to 11,925

- 12% on income 11,926 to 48,475

- 22% on income 48,476 to 103,350

Now apply each tier:

10% bracket:

11,925 × 0.10 = 1,192.50

12% bracket:

(48,475 – 11,925) = 36,550

36,550 × 0.12 = 4,386

22% bracket:

95,400 – 48,475 = 46,925

46,925 × 0.22 = 10,323.50

Total federal income tax

1,192.50 + 4,386 + 10,323.50 = 15,902

Annual federal tax = 15,902

Step 5: Calculate State Income Tax

States follow different tax structures—some have no state income tax at all.

In this example, we use a flat 4.5% rate.

State-taxable income

State tax is applied after pre-tax payroll deductions:

110,400 × 0.045 = 4,968 State tax = 4,968

Step 6: Calculate Final Net Income

Now bring everything together:

Total annual taxes:

- Federal tax: 15,902

- Social Security: 7,216.80

- Medicare: 1,687.80

- State tax: 4,968

Total taxes:

15,902 + 7,216.80 + 1,687.80 + 4,968 = 29,774.60

Final Annual Net Income

120,000 − 9,600 − 29,774.60 = 80,625.40

Final Annual Take-Home Pay: $80,625.40

This is your estimated net income after all taxes and pre-tax deductions, based on the 2025 tax structure and the example inputs.

Examples — Personal Net Income (US)

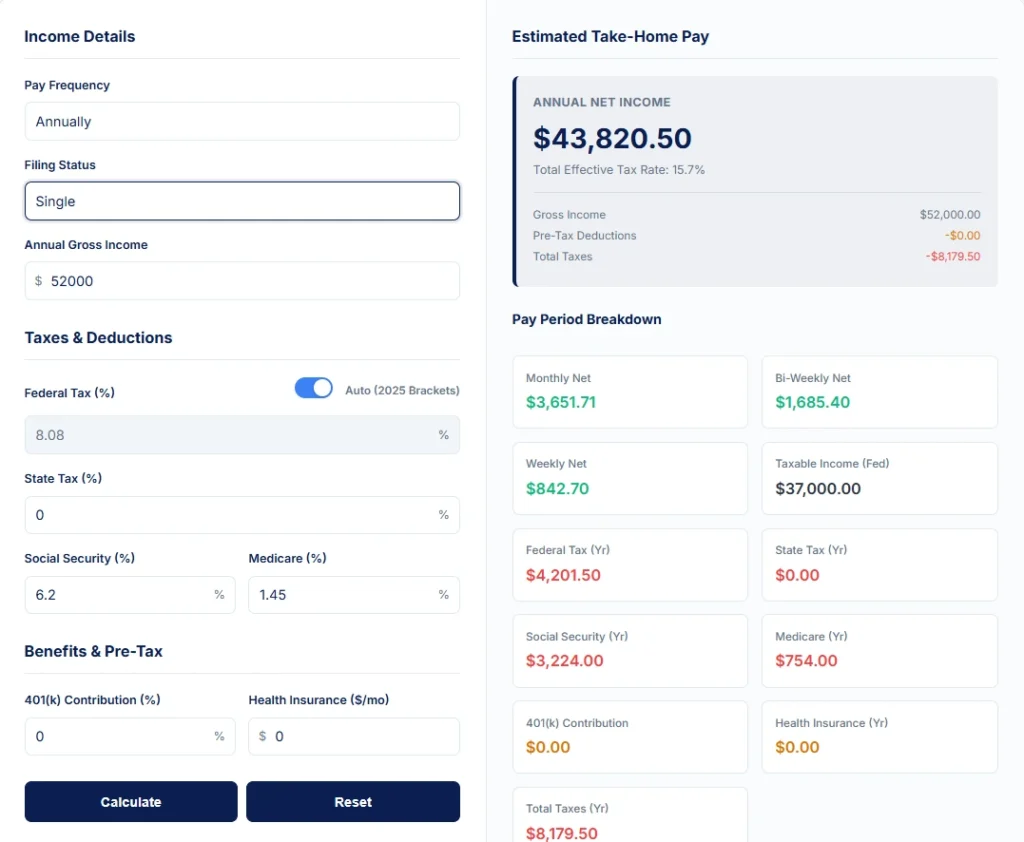

Example A: The “Simple Start” (Single, No Benefits)

Profile: Mark is a graphic designer living in a state with no income tax.

- Salary: $52,000 / year

- Status: Single

- State: Texas (No state tax)

- Benefits: None

The Calculation:

- Gross Pay: $52,000.

- Federal Taxable Income:

- $52,000 – $15,000 (Standard Deduction) = $37,000.

- Federal Tax: ~$4,201.50.

- FICA Taxable Wages:

- Mark has no pre-tax deductions, so FICA is calculated on the full $52,000.

- Social Security (6.2%): $3,224.

- Medicare (1.45%): $754.

- Total FICA: $3,978.

- Net Income:

- $52,000 – $4,201.50 – $3,978 = $43,820.50.

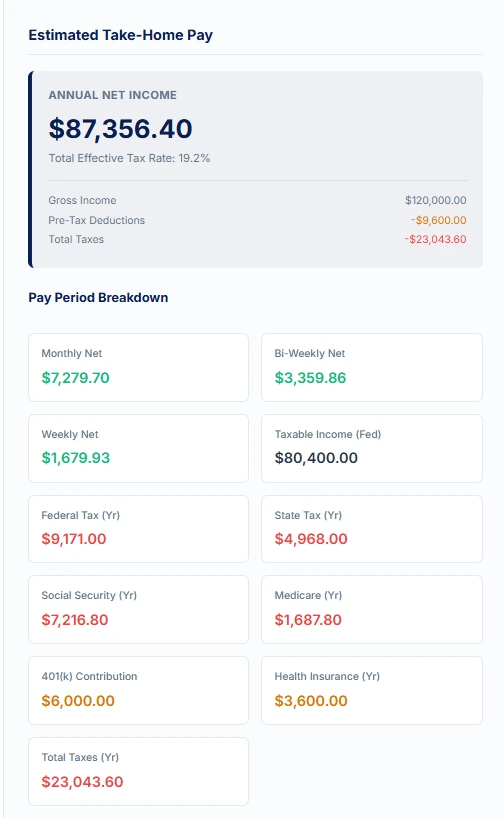

Example B: The “Loaded” Paycheck (Married, 401k, Insurance)

Profile: The Garcias are married filing jointly. This example demonstrates the “FICA Split” where your wage base differs for different taxes.

- Salary: $120,000 / year

- Status: Married Filing Jointly

- State: Flat 4.5% State Tax

- 401(k): 5% contribution ($6,000/yr)

- Health Insurance: $300 / month ($3,600/yr)

The Calculation:

- Gross Pay: $120,000.

- Determine Wage Bases:

- Federal Taxable Base: $120,000 – $6,000 (401k) – $3,600 (Health) = $110,400.

- Minus Standard Deduction ($30,000) = $80,400 Net Taxable Income.

- FICA Taxable Base: $120,000 – $3,600 (Health only) = $116,400.

- (Note: 401k contributions are NOT exempt from FICA).

- Federal Taxable Base: $120,000 – $6,000 (401k) – $3,600 (Health) = $110,400.

- Calculate Taxes:

- Federal Tax: Calculated on $80,400 income bucket = $9,171.

- FICA Tax: Calculated on $116,400 wage base.

- SS (6.2%): $7,216.80.

- Medicare (1.45%): $1,687.80.

- Total FICA: $8,904.60.

- State Tax (4.5%): Calculated on $110,400 (Gross – All Pre-tax) = $4,968.

- Net Income:

- $120,000 – $9,600 (Benefits Cost) – $9,171 (Fed) – $8,904.60 (FICA) – $4,968 (State) = $87,356.40.

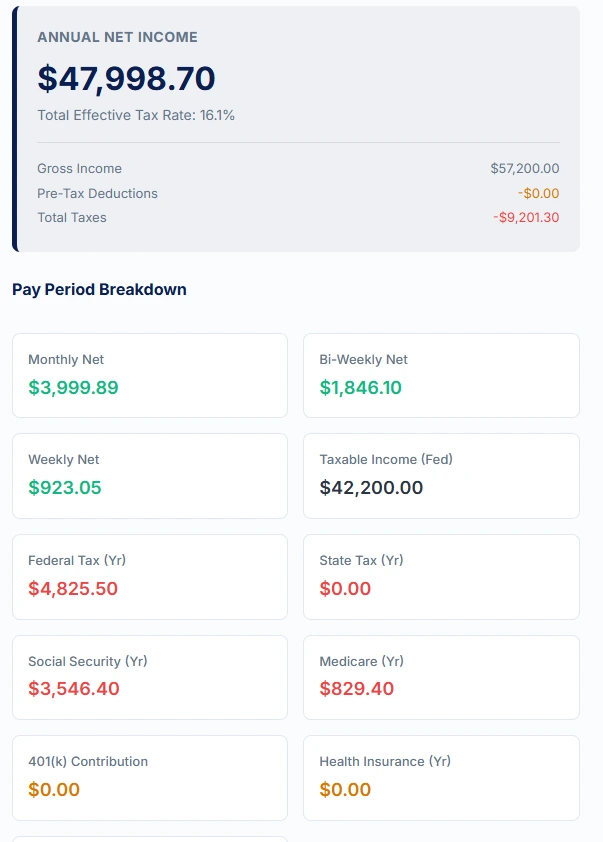

Example C: The Hourly Worker (Overtime)

Profile: Sarah works in a warehouse. She frequently works overtime, which is taxed at the same rate tables as regular income, though the withholding might feel higher in a specific week.

- Base Rate: $20.00 / hour

- Regular Hours: 40 hours / week

- Overtime Hours: 10 hours / week

- Overtime Rate: Time-and-a-half ($30.00 / hour)

- Weeks Worked: 52

- Status: Single, No State Tax, No Benefits

The Calculation (Weekly):

- Gross Pay:

- Regular: 40 hrs × $20 = $800.

- Overtime: 10 hrs × $30 = $300.

- Weekly Gross: $1,100.

- Annualized:

- $1,100 × 52 weeks = $57,200.

- Taxes (Annualized Estimates):

- Federal Taxable: $57,200 – $15,000 (Std Ded) = $42,200.

- Tax: ~$4,825.50.

- FICA Taxable: $57,200 (Full Gross).

- SS + Medicare (7.65%): ~$4,375.80.

- Federal Taxable: $57,200 – $15,000 (Std Ded) = $42,200.

- Net Pay:

- Annual Net: $57,200 – $9,201.30 = $47,998.70.

- Weekly Take-Home: ~$923.

Why Net Income Matters

Why go through all this trouble to learn how to calculate net income? Why not just use the gross number?

1. The Rent-to-Income Ratio

Landlords often require you to earn “3x the rent.” However, if your rent is $2,000 and you gross $6,000, you might qualify—but after taxes, you might only take home $4,500. Suddenly, almost half your actual money is going to rent. Knowing your take-home pay saves you from signing a lease you can’t afford.

2. Credit Card Applications

When you apply for a credit card or a mortgage, they usually ask for Gross Income. However, when you are planning how to pay that debt back, you must use Net Income. The bank cares about your ability to generate revenue; you should care about your ability to pay bills.

3. Retirement Planning

It sounds contradictory, but contributing to your retirement (reducing your immediate Net Income) can actually be a smart move. As seen in Example B above, putting money into a 401(k) lowers your tax bill. Understanding this balance helps you decide how much you can afford to save without starving today.

Net Income vs Gross Income

To summarize the differences clearly:

| Feature | Gross Income | Net Income |

| Definition | Total earnings before deductions. | The money that hits your bank. |

| Used For | Loan applications, salary negotiations. | Budgeting, paying bills, saving. |

| Includes Taxes? | Yes, taxes are included in this number. | No, taxes have been removed. |

| Size | Always the larger number. | Always the smaller number. |

| Control | You control this by asking for a raise. | You control this by adjusting deductions (like 401k). |

Common Mistakes When Calculating Net Income

When people search “how do you compute net income” and try to do it on a napkin, they usually mess up on these 5 specific things:

1. Forgetting State Taxes

People often look up “Federal Tax Brackets” and stop there. If you live in California, New York, or Minnesota, your state tax is significant. Forgetting to deduct 5% or 9% for state tax will ruin your estimation.

2. Ignoring the FICA Flat Rate

Some people think, “I only make $20k, I won’t owe taxes.” Incorrect. Even if you owe $0 in Federal Income Tax, you still owe 7.65% for FICA (Social Security + Medicare) on the very first dollar you earn.

3. Confusing “Marginal” vs. “Effective” Tax Rate

This is the most common error. If you are in the “22% Bracket,” it does not mean the government takes 22% of your check. It means they take 22% of the money above a certain limit. Your effective rate (the actual percentage you pay total) is usually much lower.

4. Misunderstanding Pay Frequency

There is a difference between being paid “Bi-Weekly” (every 2 weeks) and “Semi-Monthly” (twice a month).

- Bi-Weekly = 26 Paychecks/year. (Two months will have 3 paychecks).

- Semi-Monthly = 24 Paychecks/year.

If you use the wrong frequency, your per-paycheck calculation will be wrong.

5. Overlooking Pre-Tax Deductions

If you calculate your taxes based on your full salary, you will estimate your taxes too high. Remember to subtract your 401(k) and health insurance before applying the federal tax percentage.

Net Income Calculator (How Ours Works)

We have built a powerful tool on this page to help you calculate your 2025 net income instantly. You don’t need to do the manual math we described above.

Here is how our US Net Income Calculator handles the complex logic for you:

1. Smart “Auto-Federal Tax” Toggle

You will see a switch labeled “Auto (2025 Brackets)”.

- When ON: The calculator automatically uses the projected 2025 IRS tax brackets and standard deductions based on whether you select Single, Married, or Head of Household. It handles the progressive math for you.

- When OFF: If you want to force a specific tax rate (perhaps you know your exact effective rate from last year), you can turn this off and type in a manual percentage.

2. Accurate FICA Caps

Social Security tax is 6.2%, but only up to a certain limit. Our calculator knows that for 2025, the wage base limit is $176,100. If you earn $200,000, the tool will automatically stop deducting Social Security once you hit that cap, giving you a more accurate (and higher) net income result for high earners.

3. Pre-Tax Handling

We have separate fields for 401(k) Contribution (%) and Health Insurance ($/mo). The tool is smart enough to subtract these from your gross income before it calculates your Federal and State taxes, ensuring you don’t overestimate your tax bill.

4. Hourly vs. Salary Modes

In the “Income Details” section, if you select Hourly, the calculator changes. It opens up fields for “Hourly Rate” and “Hours Per Week.”

5. Visual Breakdown

Once you hit “Calculate,” you won’t just see a number. You get a Income Distribution Chart. This doughnut chart visually shows you exactly where your money is going—how big the “Tax” slice is compared to your “Net Income” slice.

FAQs

Ready to see your real numbers? Scroll up to the calculator, enter your gross pay, and find out exactly what your 2025 paychecks will look like.

Disclaimer

For Informational Purposes Only The “US Net Income Calculator (2025)” provided on this website is intended for general estimation and educational purposes only. It is designed to provide a ballpark figure of take-home pay based on the data you input. It is not a substitute for professional financial, tax, or legal advice.

Not Financial Advice We are not certified public accountants (CPAs), tax attorneys, or financial advisors. The results generated by this tool do not constitute a formal tax filing or legal recommendation. You should not rely solely on this calculator for making significant financial decisions.

Accuracy of Data (2025 Projections) This calculator uses projected 2025 tax brackets, standard deductions, and FICA wage base limits based on current inflation data and IRS trends. While we strive for accuracy, official IRS numbers for 2025 may differ slightly when finalized. Tax laws are subject to change, and individual circumstances (such as specific state deductions, local city taxes, or unique exemptions) may significantly affect your actual tax liability.

No Liability Our website assumes no liability for any errors, omissions, or inaccuracies in the calculation or for any actions taken in reliance on these results. Users are strongly encouraged to consult with a qualified tax professional or financial advisor before filing taxes or making financial plans.

Data Privacy Data entered into this calculator is processed locally in your browser to generate results. We do not store, save, or transmit your personal financial data to any server.