How to Calculate Current Ratio – Formula, Examples and Free Calculator

Learn how to calculate current ratio using simple formulas and real examples. Use our free current ratio calculator to measure liquidity, assess short-term financial health, and compare your results with industry benchmarks instantly.

- How to Calculate Current Ratio – Formula, Examples and Free Calculator

- Current Ratio Calculator

- What Is the Current Ratio?

- Why the Current Ratio Matters

- Current Ratio Formula

- What’s Included in Current Assets?

- What’s Included in Current Liabilities?

- Step-by-Step: How to Calculate Current Ratio

- Example Calculations with Interpretations

- How to Use Our Current Ratio Calculator

- Interpretation Guide (What Your Ratio Means)

- Industry Benchmarks (Globally Accepted)

- Current Ratio vs. Quick Ratio vs. Working Capital

- Limitations of the Current Ratio

- Frequently Asked Questions (FAQ)

- Summary

- Disclaimer

Unlike profit metrics like Net Income, which can be influenced by taxes and accounting adjustments, the Current Ratio focuses on immediate financial health. It answers one survival critical question: “Can this business pay its bills over the next 12 months?”

Because liquidity is universal, this ratio is used across the USA, UK, India, and Europe. Whether you follow US GAAP or IFRS, the logic remains the same.

In this guide, we will cover exactly how to calculate current ratio, how to interpret the numbers, and how to use our free Current Ratio Calculator to benchmark your business against global standards.

If you don’t want to run the numbers by hand, you can use our free Current Ratio Calculator below. It instantly calculates your liquidity, compares it with industry benchmarks, and shows whether your business is in the safe zone—all without any manual formulas or spreadsheets.

Current Ratio Calculator

Analysis Configuration

Financial Inputs

Current Assets

Current Liabilities

Liquidity Analysis

Current Ratio

Interpretation

Visual Breakdown

What Is the Current Ratio?

The Current Ratio is a liquidity metric that measures a company’s ability to pay short term obligations—those due within one year—using its short term assets.

In simpler terms, it compares what you have (cash and assets converting to cash soon) against what you owe (bills due soon).

Current Ratio Meaning in Business

The current ratio meaning goes deeper than just survival; it measures efficiency.

- Too Low (< 1.0): Indicates liquidity risk. The company may struggle to pay creditors.

- Too High (> 3.0): Could indicate inefficiency. The company might be hoarding cash that should be invested in growth.

This metric is often called the “working capital ratio” because it relates directly to Net Working Capital.

Why the Current Ratio Matters

You might wonder why banks care so much about this number. According to Investopedia, the current ratio is a liquidity ratio that measures a company’s ability to cover its short term obligations (due within one year) using its current assets — a key indicator of short-term financial health

Here is why learning how to calculate current ratio is mandatory for business owners and investors:

- Shows Short Term Stability: Profit is not cash. A company can be profitable on paper but still go bankrupt if it lacks cash for payroll. This ratio reveals that reality.

- Universal Standard: Whether analyzing a balance sheet in New York or Auckland, the math is identical. It requires zero translation between accounting standards.

- Critical for Lenders: If you apply for a business loan, the bank calculates this first. A ratio below 1.0 often triggers a rejection or higher interest rates.

- Hard to Manipulate: Unlike earnings, which can be “massaged” via depreciation schedules, the current ratio is derived from raw balance sheet numbers.

Current Ratio Formula

The math behind this is surprisingly simple. You do not need complex calculus; simple division is enough.

Core Formula:

Current Ratio = Current Assets ÷ Current Liabilities

Supporting Metric:

Net Working Capital = Current Assets – Current Liabilities

Our current ratio calculator above provides both of these figures automatically so you can see the ratio and the actual cash surplus.

What’s Included in Current Assets?

To understand how to calculate current ratio from current assets, you must identify what qualifies as a “current asset.” These are resources expected to be sold or used within 12 months.

- Cash & Equivalents: Physical currency, bank balances, and liquid investments.

- Accounts Receivable (AR): Money owed by customers for goods already delivered.

- Inventory: Raw materials and finished goods sitting in the warehouse.

- Prepaid Expenses: Payments made in advance (like annual insurance).

- Marketable Securities: Stocks or bonds that can be sold quickly.

Note: Long-term investments and property (PP&E) are excluded.

What’s Included in Current Liabilities?

These are debts or obligations due to creditors within one year.

- Accounts Payable (AP): Money owed to suppliers for inventory.

- Short-Term Loans: Bank overdrafts or loans due soon.

- Accrued Expenses: Wages, utilities, or rent incurred but not yet paid.

- Current Portion of Long-Term Debt: The slice of a 10-year loan that must be paid this year.

- Taxes Payable: Income or sales tax owed to the government.

Step-by-Step: How to Calculate Current Ratio

If you want to do this manually before using the tool, here is the standard procedure used in current ratio analysis.

Step 1: Sum Total Current Assets

Add up Cash, Receivables, Inventory, and other liquid assets.

Example: Cash ($50k) + Inventory ($30k) + Receivables ($20k) = $100,000.

Step 2: Sum Total Current Liabilities

Add up Payables, Short-term loans, and accrued liabilities.

Example: Payables ($40k) + Loan ($10k) = $50,000.

Step 3: Divide

Take the result from Step 1 and divide it by Step 2.

$100,000 ÷ $50,000 = 2.0

Step 4: Compare Against Benchmarks

A result of 2.0 means the company has $2.00 in assets for every $1.00 of debt. You must then compare this to the industry average current ratio.

Example Calculations with Interpretations

To truly master how to calculate current ratio, it helps to see the numbers in action. Let’s look at four distinct real-world scenarios to understand the difference between a “healthy” score and a “risky” one.

Example A: The Retailer (Default)

Industry Context: Retail has high inventory turnover and fast cash cycles, so a lower ratio is usually fine.

- Current Assets: $150,000

- Current Liabilities: $85,000

- Calculation: 150,000 ÷ 85,000 = 1.76

- Verdict:High Liquidity.

- Benchmark Check: The typical range for Retail is 1.0 – 1.5.

- Interpretation: At 1.76, this business is well above the industry norm. While very safe, they might be holding slightly too much inventory compared to competitors who operate leaner.

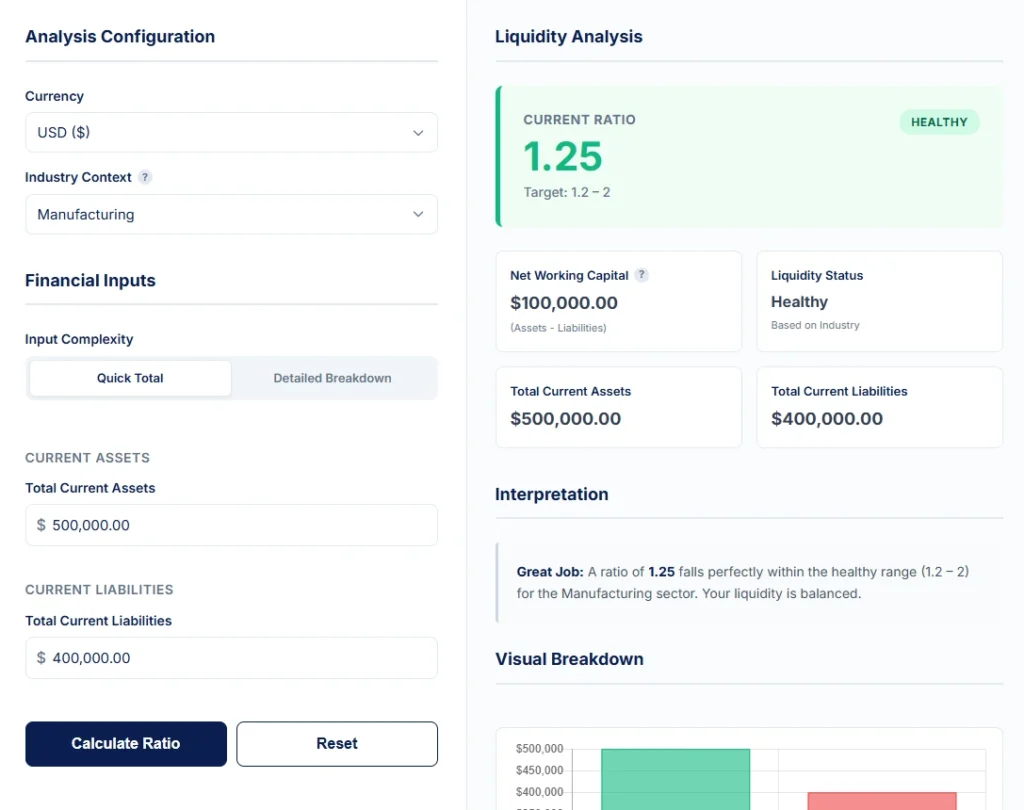

Example B: The Manufacturing Giant

Industry Context: Manufacturers need higher working capital for raw materials and production cycles.

- Current Assets: $500,000

- Current Liabilities: $400,000

- Calculation: 500,000 ÷ 400,000 = 1.25

- Verdict:Healthy / Stable.

- Benchmark Check: The typical range for Manufacturing is 1.2 – 2.0.

- Interpretation: A score of 1.25 falls safely inside the healthy zone. It indicates the factory has enough assets to cover debts, though it is on the lower end of the spectrum compared to a company with a 2.0 ratio.

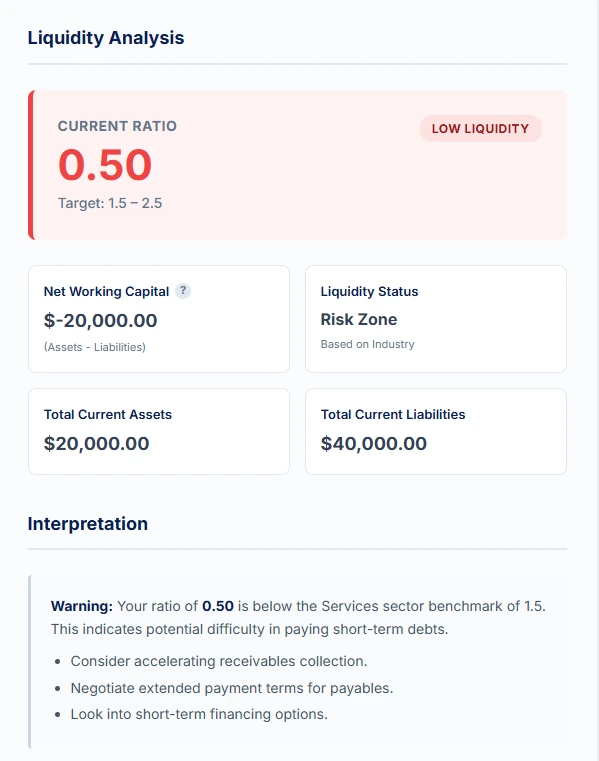

Example C: The Struggling Service Agency

Industry Context: Service firms (Consulting/Agencies) rely on cash and receivables, not inventory. They generally need higher ratios.

- Current Assets: $20,000

- Current Liabilities: $40,000

- Calculation: 20,000 ÷ 40,000 = 0.50

- Verdict:LOW LIQUIDITY

- Benchmark Check: The typical range for Services is 1.5 – 2.5.

- Interpretation: The company owes twice as much as it owns. With a benchmark minimum of 1.5, a score of 0.50 is a critical warning sign of potential insolvency.

Example D: The “No Debt” Freelancer

Industry Context: Small businesses often operate without any loans.

- Current Assets: $10,000

- Current Liabilities: $0

- Calculation: 10,000 ÷ 0 = Infinity (∞)

- Verdict:No Debt.

- Interpretation: While mathematically undefined, in business terms, this represents perfect liquidity. There is zero risk of default.

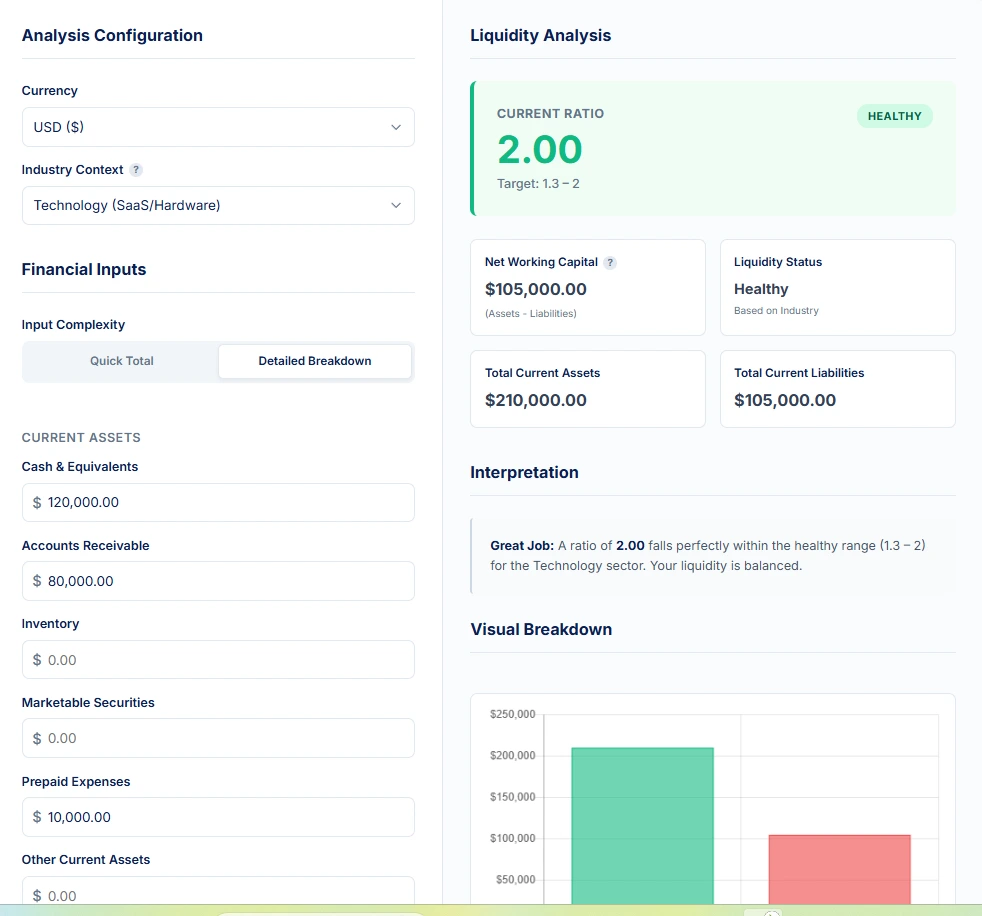

Example E: The Detailed Tech Scale-Up

Industry Context: Tech companies generally have high revenue predictability and strong cash positions. Sometimes you don’t have the totals ready and need to input specific line items. Here is how the Detailed Breakdown mode works for a Tech company.

1. Assets Input:

- Cash: $120,000

- Accounts Receivable: $80,000

- Prepaid Expenses: $10,000

- Total Assets: $210,000

2. Liabilities Input:

- Accounts Payable: $40,000

- Short-Term Loans: $50,000

- Accrued Expenses: $15,000

- Total Liabilities: $105,000

3. The Result:

- Calculation: 210,000 ÷ 105,000 = 2.00

- Verdict:Healthy / Strong.

- Benchmark Check: The typical range for Technology is 1.3 – 2.0.

- Interpretation: Hitting exactly 2.0 puts this company at the top end of the healthy range. It shows a perfect balance—enough cash to be safe, but not so much that it’s sitting idle.

How to Use Our Current Ratio Calculator

We have built a robust current ratio calculator designed for global use. Whether you are analyzing a balance sheet in New York, London, or Mumbai, this tool adapts to your needs.

1. Configure Your Settings

At the top, select your Currency ($, €, ₹, £, etc.).

- Why? This ensures your report and charts display the correct symbol for your region. The calculator automatically formats all numbers in the standard financial format (e.g., 1,000.00).

2. Choose Your Industry

Click the “Industry Context” dropdown. Select your sector (e.g., “Tech” or “Retail”).

- Smart Feature: This automatically updates the “Target” range logic. For example, selecting “Energy” lowers the safe target to 0.8–1.3 because that sector operates safely with less liquid cash.

3. Input Your Data

- Quick Total: Enter the total sums for Assets and Liabilities if you already have them calculated.

- Detailed Breakdown: Toggle to “Detailed” mode to enter specific line items like Cash, Inventory, and Accounts Payable individually. The tool will sum them up for you.

4. Click “Calculate”

The tool will instantly display:

- Your Current Ratio (e.g., 1.76)

- Net Working Capital ($ amount)

- A visual status badge: Healthy, Risk, or High Liquidity

Interpretation Guide (What Your Ratio Means)

Knowing how to interpret current ratio results is vital. The number alone lacks context without these general rules:

- Under 1.0 (Liquidity Risk): Negative working capital. You may struggle to pay bills next month. Action: Raise capital or negotiate longer payment terms.

- 1.0 – 1.49 (Acceptable): Common for efficient businesses like grocery stores. Action: Monitor cash flow closely.

- 1.5 – 2.0 (Healthy): The ideal current ratio for most industries. You have a buffer to survive a downturn but are still efficient.

- Over 3.0 (Excess Liquidity): Safe, but potentially inefficient. Management might be hoarding cash or holding obsolete inventory.

Industry Benchmarks (Globally Accepted)

One of the most common questions is: “What is a good current ratio for my specific business?”

A software company and a factory should not have the same target. The table below outlines the globally accepted ranges used by our calculator logic.

Below is the globally accepted benchmark table used by analysts, lenders, and investors across major industries.

📊 Current Ratio Benchmarks by Industry

| Industry | Typical Range | Why This Range (Global Explanation) | Interpretation Guidance |

| Retail | 1.0 – 1.5 | Retail has high inventory, low margins, and fast cash cycles. | Ratios slightly above 1.0 are normal. Too high (>2.0) may show inefficient inventory usage. |

| Manufacturing | 1.2 – 2.0 | Requires high working capital for raw materials & production. | Ratios around 1.5–2.0 reflect healthy liquidity for manufacturing operations. |

| Services (Consulting, Agencies) | 1.5 – 2.5 | Very low inventory requirements; rely mainly on receivables & cash. | Higher ratios (>2.0) indicate strong liquidity; <1.5 may signal cash flow tightness. |

| Technology (SaaS, Electronics) | 1.3 – 2.0 | High revenue predictability, lower physical inventory, strong cash position. | Ratios above 1.5 are generally healthy. <1.3 can be a warning sign. |

| Healthcare (Hospitals, Pharma) | 1.2 – 1.8 | Stable demand, moderate inventory, predictable receivables. | Ratios near 1.5 show balanced liquidity; below 1.2 may indicate pressure. |

| Energy & Utilities | 0.8 – 1.3 | Heavy capital expenditure and regulated pricing; often operate with low liquidity. | Ratios around 1.0 are normal. >1.5 may indicate unnecessary idle cash. |

| Transportation | 1.0 – 1.6 | Moderate inventory, high operating expenses, steady receivables. | 1.2–1.5 is considered healthy; below 1.0 suggests risk. |

| Real Estate & Construction | 1.2 – 2.2 | Long project cycles, high payables, heavy cash flow dependency. | >1.5 shows good short-term liquidity; <1.2 indicates possible delays or strain. |

| Food & Beverage | 1.0 – 1.6 | Fast-moving inventory and thin profit margins. | Ratios near 1.2–1.4 are typical; high ratios may signal slow inventory turnover. |

| E-Commerce | 1.0 – 1.7 | Inventory-heavy but fast cash conversion cycles. | 1.2–1.6 is healthy; <1.0 indicates short-term payment pressure. |

| Telecommunications | 0.9 – 1.4 | Stable cash flows but high long-term liabilities. | Ratios around 1.2 are normal. <1.0 may require attention. |

| Agriculture & Farming | 1.2 – 2.5 | Seasonal revenue patterns and inventory fluctuations. | Higher ratios are common due to cyclical cash inflows. |

| Mining & Metals | 1.0 – 1.8 | Commodity prices cause liquidity volatility. | Ratios around 1.3–1.6 indicate stable liquidity. |

| Automotive | 1.1 – 1.7 | Heavy working capital needs and cyclical demand. | Ratios around 1.3–1.5 show healthy liquidity. |

| General / All Industries | 1.0 – 2.0 | Global average range across mixed company types. | A ratio within this range is considered acceptably liquid for most industries. |

| Banks & Finance | N/A | Banks use different liquidity measures (current ratio is meaningless). | Use Liquidity Coverage Ratio (LCR) instead. |

| Insurance | N/A | Reserves and actuarial requirements make current ratio irrelevant. | Use Solvency Ratios instead. |

Important Note: Our calculator automatically disables analysis for “Financial Institutions” because banks and insurance companies have unique balance sheet structures where customer deposits are liabilities, not debt in the traditional sense.

Current Ratio vs. Quick Ratio vs. Working Capital

When learning how to calculate current ratio, you will inevitably compare it to its stricter cousin: The Quick Ratio.

| Feature | Current Ratio | Quick Ratio (Acid Test) | Net Working Capital |

| Formula | Current Assets / Current Liab. | (Current Assets – Inventory) / Current Liab. | Current Assets – Current Liab. |

| Measurement | General Liquidity | Immediate Liquidity | Dollar value of liquidity |

| Inventory? | Yes | No | Yes |

| Best Used For | Retail, Manufacturing | Service firms, or slow-moving inventory | Budgeting & Cash Flow |

Why the difference?

Imagine a luxury yacht seller. They have $10M in assets, but $9M is yachts sitting in the dock. If they owe a $500k tax bill tomorrow, they can’t sell a yacht overnight. In this case, their Current Ratio is high (good), but their Quick Ratio is low (bad).

For general purposes, the current ratio is the standard. For a “worst-case scenario” stress test, use the Quick Ratio.

Limitations of the Current Ratio

While valuable, knowing how to calculate current ratio from balance sheet data has limitations. It is a snapshot in time—specifically, the last day of the reporting period.

- Inventory Valuation: Obsolete products (e.g., old phone cases) are still counted as “Current Assets,” inflating the ratio artificially.

- Timing Manipulation: Companies can “window dress” their ratio by delaying purchases just before the quarter ends.

- No Cash Flow Visibility: You can have a great ratio but zero cash if all your assets are stuck in Accounts Receivable (customers who haven’t paid).

- Seasonality: A toy company in January has a very different ratio than in October.

Frequently Asked Questions (FAQ)

Summary

Understanding how to calculate current ratio gives you X-ray vision into a business. It allows you to look past “high revenue” and see if the company actually has the liquid resources to survive.

- The Formula: Current Assets ÷ Current Liabilities.

- The Goal: Aim for 1.2 to 2.0.

- The Context: Always compare results to the industry average current ratio.

- The Tool: Use our current ratio calculator above to track liquidity quarterly.

Disclaimer

The information provided in this article and via the calculator is for educational purposes only and does not constitute professional financial advice. Always consult with a qualified accountant or financial advisor regarding your specific business situation.