How to Calculate Interest Amount Per Month for Loans and Investments with Formula, Examples and Free Calculator

Let’s be honest. When you take out a loan, you probably look at the monthly payment. When you open a savings account, you look at the annual percentage (APY). But almost nobody stops to look at the most critical number of all: the monthly interest.

If you ignore this number, you are flying blind.

For borrowers, the monthly interest is the “rent” you pay for using someone else’s money. In the early days of a mortgage, this amount is massive—often eating up 70% or more of your monthly payment. For investors, it represents your actual cash flow or the speed at which your wealth compounds.

Understanding how to calculate interest amount per month gives you X-ray vision into your finances. It stops you from making expensive mistakes, like refinancing a loan when you shouldn’t, or choosing a savings account that looks good on paper but pays out poorly in reality.

In this guide, we are going to break down the math simply. No complex jargon, no robotic definitions. Just the logic you need to verify your bank’s numbers and a guide on how to use our free calculator to do the heavy lifting for you.

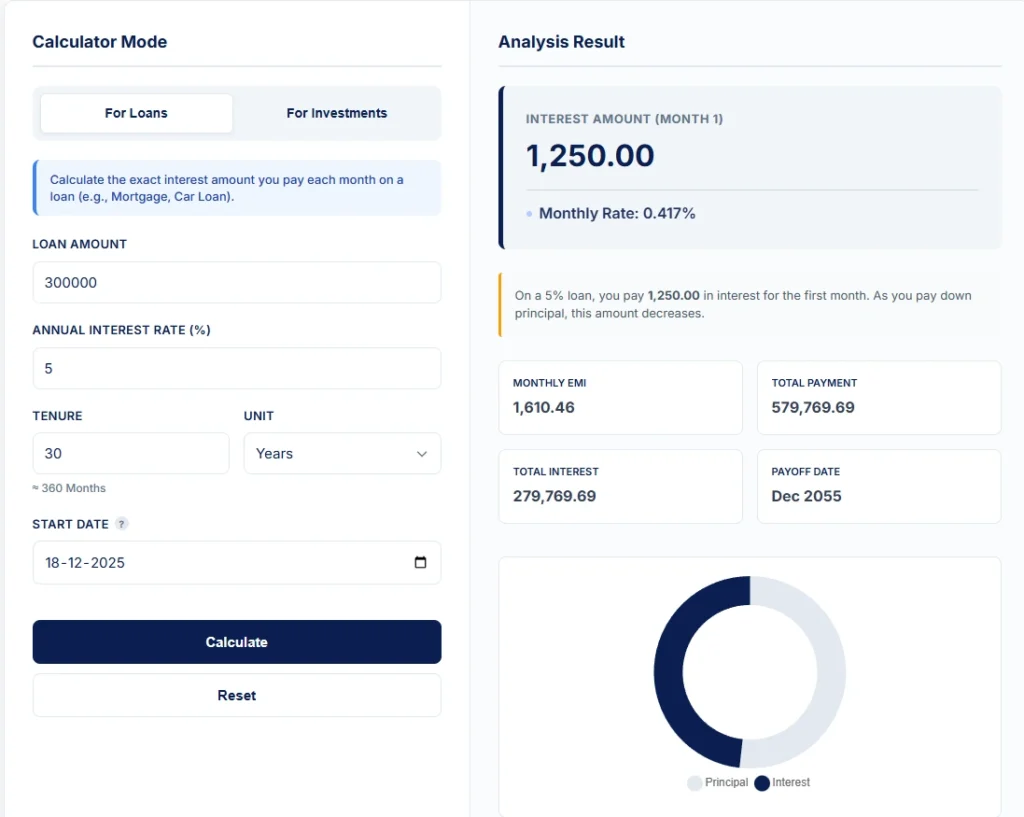

Don’t waste time doing manual math — use our free calculator below to instantly see your exact monthly interest and breakdown.

Monthly Interest Amount Calculator

Calculator Mode

Analysis Result

Monthly Interest Paid

- How to Calculate Interest Amount Per Month for Loans and Investments with Formula, Examples and Free Calculator

- What Is Interest Amount Per Month?

- Where Monthly Interest Applies in Real Life

- How Interest Is Calculated Monthly in Finance

- How to Calculate Interest Amount Per Month on Loans

- How to Calculate Interest Amount Per Month on Investments

- Loan vs. Investment Monthly Interest Comparison

- Monthly Interest vs. Monthly payment vs. Total Interest Paid

- How to Calculate Monthly Interest Using Our Free Calculator

- Monthly Interest Examples with Interpretation

- How Compounding Frequency Affects Monthly Interest

- Common Mistakes When Calculating Interest per month

- When Monthly Interest Becomes Dangerous (or Powerful)

- Frequently Asked Questions (FAQ)

- Summary

- Beyond the Month: Two Critical Calculations You Must Know

- Disclaimer

What Is Interest Amount Per Month?

Before we dive into the math, we need to clear up a common confusion.

Interest Rate vs. Interest Amount

- The Rate: This is the percentage the bank quotes you (e.g., 10% p.a. or per annum). It is a speed limit.

- The Amount: This is the actual cash value (e.g., $500 or €5,000) that leaves your pocket or enters your account every month.

Most financial products are quoted annually, but they charge or pay you monthly. This mismatch is where people get confused.

When you learn how to calculate interest amount per month, you are essentially converting that annual speed limit into a concrete dollar or euro value for a specific 30-day period. This concept is universal. Whether you are in New York calculating dollars, London calculating pounds, or Mumbai calculating rupees, the math remains exactly the same.

Where Monthly Interest Applies in Real Life

You encounter this number more often than you realize. It shows up in two distinct areas of your financial life:

1. Monthly Interest in Loans (The Cost)

This is money leaving your pocket.

- Home Loans (Mortgages): The biggest culprit. In the first few years, your payment is almost entirely interest.

- Personal Loans & Auto Loans: These follow an amortization schedule where the interest portion drops slowly every month.

- Credit Cards: If you don’t pay in full, the monthly interest is calculated on your average daily balance.

2. Monthly Interest in Investments (The Income)

This is money entering your pocket.

- Savings Accounts: Banks pay a tiny bit of interest into your account every month.

- Fixed Deposits / CDs: You might choose a “monthly payout” option to get a regular income stream.

- Bonds: While many pay semi-annually, some income funds distribute cash monthly.

How Interest Is Calculated Monthly in Finance

At first glance, you might think monthly interest is calculated by taking the total loan amount, multiplying it by the interest rate, and dividing by 12.

That method applies only to flat-rate loans, which are uncommon today and often associated with higher borrowing costs.

In most modern financial systems, lenders use the Reducing Balance (Amortization) Method.

The fundamental principle is simple: interest is charged only on the amount you still owe.

- Annual to Monthly Conversion: Lenders convert the annual interest rate (for example, 12%) into a monthly rate by dividing it by 12, resulting in a 1% monthly rate.

- How It’s Applied: This monthly rate is applied to your outstanding loan balance, not the original loan amount.

Because your loan balance decreases with each payment, the interest charged changes every month.

How to Calculate Interest Amount Per Month on Loans

To master the math, you first need to understand the relationship between your Principal (the balance you owe), the Rate, and the Tenure (how long you have the loan).

The Core Concept: Reducing Balance

Imagine you owe $100,000. If you pay off $500 of the principal this month, next month you only owe $99,500. Therefore, the bank can only charge you interest on the new, lower balance of $99,500.

This is why your interest amount drops slightly every month, even though your monthly payment/installment stays the same.

The Formula Use this formula to find the interest portion of your payment for any specific month:

Monthly Interest = Outstanding Loan Balance × (Annual Interest Rate ÷ 12)

Step-by-Step Calculation (Real Example)

Let’s look at a real example. Suppose you have a loan of $50,000 at 6% interest for a 5-year tenure.

- Identify the Balance: For the first month, it is the full $50,000.

- Get the Monthly Rate: 6% divided by 12 months = 0.5% (or 0.005).

- Calculate:

$50,000 × 0.005 = $250

Result: Your interest for Month 1 is $250.

If your total payment is $966, here is how it splits:

- $250 goes to Interest (The cost of borrowing).

- $716 goes to Principal (Reduces your loan balance).

What Happens Next Month?

This is where the magic happens. In Month 2, your new balance is $49,284 ($50,000 – $716).

New Calculation: $49,284 × 0.005 = $246.42

See that? The interest dropped by $3.58. This slow decline is the heartbeat of every loan.

How to Calculate Interest Amount Per Month on Investments

Investments are more fun because the money is coming to you. However, the calculation depends on your Tenure (how long you stay invested) and what you do with the interest.

Case 1: Simple Monthly Interest (Income Focus)

This applies if you use a “Monthly Income Scheme” where the bank deposits the interest into your checking account every month. Your Principal never grows; it just sits there earning rent.

The Formula: Monthly Payout = Invested Amount × (Annual Interest Rate ÷ 12)

Example: You put $100,000 in a Fixed Deposit at 6% for a 5-year tenure.

- Math: $100,000 × 0.005 = $500

- Outcome: You get a $500 check every month. Your balance remains $100,000 throughout the tenure.

Case 2: Compound Monthly Interest (Growth Focus)

This is where Tenure becomes your best friend. If you don’t withdraw the interest, it gets added to your balance. Next month, you earn interest on your original money plus the interest you just earned.

The Formula: New Balance = Previous Balance + (Previous Balance × (Annual Interest Rate ÷ 12))

Example: Same $100,000 at 6%.

- Month 1: You earn $500. Your new balance becomes $100,500.

- Month 2: You calculate interest on the new balance.

Math: $100,500 × 0.005 = $502.50

You earned an extra $2.50 just for doing nothing. Over a long Tenure, this “Snowball Effect” turns small sums into massive wealth.

Loan vs. Investment Monthly Interest Comparison

It helps to see these two side-by-side to understand the different dynamics.

| Feature | Loans | Investments |

| Purpose | You borrow money. | You grow money. |

| Monthly Interest Effect | It is a Cost (Expenses). | It is Earnings (Income). |

| Balance Trend | The balance Decreases over time. | The balance Increases (if compounding). |

| Monthly Interest Amount | Falls every month. | Rises every month (if compounding). |

| Financial Impact | Drains your wealth. | Builds your wealth. |

Monthly Interest vs. Monthly payment vs. Total Interest Paid

When people search for how to calculate interest amount per month, they often confuse it with monthly payment. They are not the same.

| Metric | Meaning | Why It Matters |

| Monthly Interest | The pure cost of funds for that specific month. | Shows you the real efficiency of your loan or savings. |

| Monthly Payment | A combined payment of Principal + Interest. | This is what you budget for, but it hides the true cost. |

| Total Interest Paid | The sum of all interest over the loan life. | The “sticker price” of the loan. |

| Total Investment Value | The final maturity amount. | The ultimate goal of investing. |

How to Calculate Monthly Interest Using Our Free Calculator

We have built a tool to handle both sides of the coin—loans and investments. You don’t need to mess around with Excel formulas. Our calculator switches logic instantly based on your needs.

Here is a guide on how to use the features embedded in the tool above.

1. Calculator Modes Explained

At the top of the calculator, you will see two tabs: “For Loans” and “For Investments”.

- Loan Mode: Focuses on how much interest you are paying to the bank. It uses the reducing balance method standard in the US, UK, India, and Europe.

- Investment Mode: Focuses on how much you are earning. It unlocks extra options like “Compounding Frequency” to see the difference between monthly, quarterly, and yearly growth.

2. Required Inputs

To get an accurate result, you need to input:

- Principal Amount: The total loan or investment size.

- Annual Interest Rate (%): The yearly rate quoted by your bank.

- Tenure: How long the loan/investment lasts. You can toggle the unit between “Years” and “Months”.

- Investment Specifics: If you are in Investment mode, you can select the Interest Method (Compound Interest vs. Simple Interest Payout).

3. Outputs Generated

Once you hit Calculate, the tool provides a comprehensive analysis:

- Main Result: For loans, it shows the “Interest Amount (Month 1)”. For investments, it shows the “Avg. Monthly Interest” or “Monthly Payout”.

- Key Metrics: You will see the total interest, total payment/maturity value, and the exact end date of your tenure.

- Visual Charts: A clean chart visually breaks down how much of your money is Principal vs. Interest.

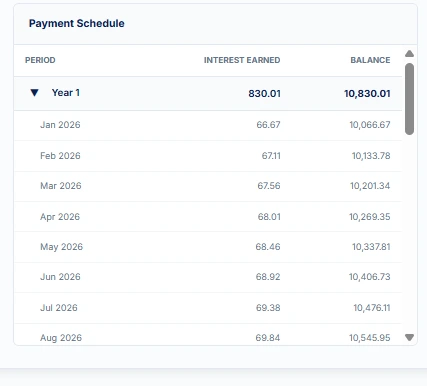

4. The Schedule (X-Ray Vision)

This is the most powerful feature. The calculator generates a Payment Schedule table.

- It lists every month of your tenure.

- You can see the exact breakdown of Interest vs. Principal for any specific month.

- It supports an expandable “Yearly” view to keep the list tidy.

Monthly Interest Examples with Interpretation

Let’s apply what we have learned to three real-world scenarios.

Example 1: The Home Loan (Mortgage)

The Scenario: You borrow $300,000 at 5% interest for a 30-year tenure.

- The Math: ($300,000 × 0.05) ÷ 12 = $1,250.

- The Result: Your total monthly payment is roughly $1,610.

- The Interpretation (The Trap): Look closely at that split. Out of your $1,610 payment, $1,250 vanishes immediately to pay the bank’s interest. Only $360 actually lowers your loan balance.

- Why this matters: In the early years of a loan, you are mostly paying rent on the money, not paying off the house. This calculator helps you see exactly how much “dead money” goes to interest every month.

Example 2: The Fixed Deposit (The Pensioner)

The Scenario: A retiree puts $500,000 into a safe Fixed Deposit (FD) paying 7% annually. They want a steady paycheck without touching their savings.

- The Math: ($500,000 × 0.07) ÷ 12 = $2,916.67.

- The Result: A monthly income of $2,916.67.

- The Interpretation (The Paycheck): This is the “Simple Interest” model (select Simple Interest in the calculator). The retiree gets a check for nearly $3,000 every month, and at the end of the 5 or 10 years, they still have their original $500,000 intact. This calculation helps plan retirement income.

Example 3: The Compound Growth (The Young Investor)

The Scenario: A young investor puts $10,000 into an index fund averaging 8% growth. They don’t touch it for 10 years.

- Month 1 Math: ($10,000 × 0.08) ÷ 12 = $66

- Year 10 Math: By Year 10, the balance has grown to roughly $22,000. The new interest calculation is ($22,000 × 0.08) ÷ 12 = $146.

- The Interpretation (The Snowball): Notice the difference? In Month 1, your money earned you $66. By Year 10, the same original investment is earning you $146 per month.

- The Average: It starts low and ends high, but the average monthly interest on the investment will be $101.64.

- Why this matters: You didn’t do any extra work. The “Interest on Interest” doubled your monthly passive income. Use the “Compound Interest” mode above to see how fast your money can snowball over time.

How Compounding Frequency Affects Monthly Interest

If you are an investor, “Frequency” is a secret weapon. A rate of 10% calculated monthly is actually better than 10% calculated yearly.

| Compounding Frequency | Monthly Interest Impact |

| Monthly | Standard. Interest is added 12 times a year. Your money grows faster. |

| Quarterly | Common. Interest is added every 3 months. Slightly slower than monthly. |

| Annually | Slowest. Interest is only added once a year. You miss out on “interest on interest” for 11 months. |

| Daily | High Speed. Used by some high-yield savings accounts. Maximizes growth. |

Why does this matter? When comparing two savings accounts, if Rate A is 5% (Yearly) and Rate B is 4.9% (Monthly), Rate B might actually earn you more money because of the frequency.

Common Mistakes When Calculating Interest per month

Even smart people trip up on these hurdles.

- Confusing Rate with Yield: Banks advertise “APY” (Annual Percentage Yield) which already includes the effect of compounding. If you try to calculate monthly interest using APY, your numbers will be slightly off. You should use the base “Interest Rate” (APR).

- Judging Loans by monthly payment Only: A lower monthly payment often means a longer tenure. Longer tenure means you pay more monthly interest for more months. Always check the “Total Interest” figure.

- Ignoring the Reducing Balance: Many people think if they have a 5-year loan, they pay the same interest in Year 1 as in Year 5. This is false. In Year 5, your monthly interest cost is tiny.

- The “Flat Rate” Trap: Some car dealerships quote a “Flat 4%”. This sounds cheap, but it is calculated on the original loan amount, not the reducing balance. A “Flat 4%” is roughly equal to a standard “Reducing 7-8%”. Always ask: “Is this reducing balance?”

When Monthly Interest Becomes Dangerous (or Powerful)

Understanding how to calculate interest amount per month isn’t just math—it’s risk management.

When it is Dangerous:

- Credit Card Minimums: Minimum payments usually cover only the monthly interest + 1% of the principal. If you only pay the minimum, you are essentially treading water, paying the bank rent forever without reducing your debt.

- Negative Amortization: In some rare loans, if your payment is less than the monthly interest amount, the unpaid interest gets added to your loan balance. You end up owing more than you borrowed.

When it is Powerful:

- Prepayments: If you pay an extra $100 towards your loan principal today, you stop that $100 from generating interest charges for the next 20 years. That single $100 could save you $200 in future interest.

- Reinvestment: For investors, manually clicking “Reinvest Dividends” changes your math from simple linear growth to exponential geometric growth.

Frequently Asked Questions (FAQ)

Summary

We have covered a lot of ground. Here is the cheat sheet for your financial journey:

- Look Deeper: The monthly payment is just the wrapper; the monthly interest is the contents.

- Opposing Forces: Interest eats into your loan repayments but accelerates your investment growth.

- The Golden Rule: Always verify if the calculation is “Flat Rate” (bad for borrowers) or “Reducing Balance” (standard).

- Use the Tool: Don’t guess. Use our free calculator to generate the schedule. seeing the numbers laid out month-by-month is the best way to understand the true cost or value of your money.

By knowing how to calculate interest amount per month, you move from being a passive participant in the banking system to an active manager of your own wealth.

Beyond the Month: Two Critical Calculations You Must Know

Once you master the monthly figures, you need to zoom out to see the bigger picture. Here is a quick guide on how to calculate the “Sticker Price” of your loan and the “True Speed” of your wealth growth.

1. How to Calculate Total Interest Paid

The monthly interest tells you the current cost, but the Total Interest Paid tells you the lifetime cost of the loan. This is the number banks often hide in the fine print because it can be shocking.

- The Concept: It is the difference between what you actually pay back and what you originally borrowed.

- The Formula:

Total Interest = (Monthly paymenrt × Total Months) – Principal Loan Amount

- Why It Matters: A lower monthly payment often tempts people into longer tenures. However, a longer tenure means you pay interest for more months, which drastically increases this total figure.

- Example: On a $300k mortgage, extending the term from 20 to 30 years might lower your monthly bill, but it could add $100,000 to your Total Interest Paid.

2. How to Calculate Real Interest Rate

If you are an investor, the “Interest Rate” your bank advertises (the Nominal Rate) is not what you actually keep. You must account for inflation, which eats away at your purchasing power.

- The Concept: The Real Interest Rate removes the “fluff” of inflation to show how much your wealth is actually growing in terms of buying power.

- The Formula (Simplified):

Real Interest Rate = Nominal Interest Rate – Inflation Rate

- The Interpretation:

- Scenario: Your savings account pays 5% interest.

- The Catch: Inflation is currently 4%.

- The Reality: Your Real Interest Rate is only 1% ($5\% – 4\%$).

- Why It Matters: If your Real Interest Rate is negative (i.e., Inflation > Interest Rate), you are technically losing wealth every day, even if your bank balance is going up. This calculation helps you choose investments that genuinely build wealth.

Disclaimer

This article and the attached calculator are for educational purposes only. Banking regulations, tax rules, and rounding methods vary by country and institution. Always consult a financial advisor or check your specific loan agreement for exact figures.