How to Calculate Interest Percentage on a Loan: Formula, Examples and Calculator

You sign the papers, the money hits your account, and you start paying the monthly payment. It seems simple enough. But there is a catch: knowing your monthly payment is not the same as knowing the true cost of the loan. A bank might quote you one rate, but when you do the math on the total money leaving your pocket, the reality is often different.

Many borrowers realize too late that they are paying far more than they expected. Whether you are in New York, London, or Sydney, the banking logic is the same. Lenders use complex schedules that front-load the interest, meaning you pay mostly interest in the early years.

If you don’t know how to calculate interest percentage on a loan, you are effectively flying blind. In this guide, we will break down the math, show you the difference between “Flat” and “Effective” rates, and help you use our Loan Interest Rate Finder to uncover the real numbers hidden inside your monthly payment.

Don’t want to do the manual math? Use the calculator below to find the exact interest rate instantly.

Loan Interest Percentage Calculator

Loan Parameters

Result Analysis

Effective Interest Rate

Flat Interest Rate

* This calculator estimates the interest rate based on loan repayments only and does not include processing fees, insurance, or taxes.

Methodology & Notes:

• Effective Interest Rate: Reflects the annualized cost including the effect of compounding. Assumes monthly compounding and equal monthly payments.

• Flat Rate: Calculates interest on the original principal amount throughout the tenure, regardless of repayments.

• Calculation: Effective rate is derived solving the standard amortization formula:

Monthly Payment = [P x r x (1+r)^N] / [(1+r)^N - 1]- How to Calculate Interest Percentage on a Loan: Formula, Examples and Calculator

- What Is Interest Percentage on a Loan?

- Why Loan Interest Percentage Is Hard to See

- Information Required to Calculate Interest Percentage

- Interest Percentage Formula

- What’s Included (And What’s Not)?

- Step-by-Step: How to Calculate Interest Percentage Manually

- Example Calculations with Interpretation

- How to Use Our Interest Percentage Calculator

- Interpretation Guide (What Your Interest Percentage Means)

- Interest Percentage vs. Advertised Loan Rate

- Frequently Asked Questions (FAQ)

- Summary

- Beyond the Month: Critical Calculations You Must Know

- Disclaimer

What Is Interest Percentage on a Loan?

The interest percentage is the “rent” you pay for using someone else’s money. However, in the lending world, there are two ways to present this number. Lenders often prefer the one that looks lower to close the deal.

- The Flat Rate: This assumes you owe interest on the original full loan amount for the entire duration . It is rarely used by major banks but is common in dealership financing or personal lending to make a loan look cheap.

- The Reducing Balance Rate (Effective Rate): This is the standard banking method. As you pay back the principal, you only pay interest on the balance left .

Learning how to calculate interest percentage on a loan correctly means understanding that your “real” cost is the Effective Interest Rate. This number reveals how hard your money is actually working against the debt.

Why Loan Interest Percentage Is Hard to See

You might ask, “Why do I need to calculate this? It’s on the loan document.”

The problem is the amortization structure. Most loans use fixed installments. This means your monthly payment is constant, but the split inside it changes every month.

- Month 1: You pay mostly interest, very little principal.

- Month 60: You pay mostly principal, very little interest.

Because of this shifting balance, a simple calculation often gives you the wrong answer. If you just add up your payments and divide by the years, you get the “Flat Rate,” which is deceptively lower than the “Annualized Percentage Rate” (APR) or effective rate the bank charges . To get the actual interest rate on loan repayments, you need to dig deeper.

Information Required to Calculate Interest Percentage

Before we look at the formulas, you need to gather four specific numbers. You can usually find these on your loan sanction letter or your banking app.

- Loan Principal Amount: The original amount you borrowed .

- Loan Duration: The time you have to pay it back (in years or months) .

- Total Interest Paid OR Monthly Payment: You need at least one of these .

- Payment Frequency: Usually monthly.

Once you have these, you are ready to learn how to calculate interest percentage on a loan.

Interest Percentage Formula

Depending on the numbers you have in front of you, there are two ways to calculate this. Our calculator handles the complex math to find the precise effective rate, but here are the formulas so you understand the logic behind the numbers.

Method 1: Flat Interest Cost Percentage (Quick Estimate)

This method gives you a rough, non-compounding estimate. It simply tells you how much total interest you are paying relative to the loan amount.

Formula: Flat Interest % = (Total Interest Paid ÷ Principal Amount ÷ Loan Duration in Years) × 100

When to use: Use this for quick comparisons, early screening of offers, or checking “flat rate” dealership loans.

Note: This is not the true banking rate because it ignores the fact that your principal balance decreases every month.

Method 2: Effective Interest Rate (Reducing Balance Method)

This formula reveals the real cost of borrowing. It assumes you only pay interest on the money you still owe, which is how most banks actually charge you.

The monthly payment is calculated using:

Formula: Monthly Payment = [ P × r × (1+r)^N ] / [ (1+r)^N − 1 ]

Where:

- P = Principal (Loan Amount)

- r = Monthly Interest Rate

- N = Total Number of Months

When to use: This represents the true borrowing cost (APR). To find the rate (r) from this formula, you have to work backward using complex iteration—which is exactly why financial calculators are essential.

Rule of Thumb: For most consumer loans, the effective interest rate is usually 1.6 to 2 times higher than the flat interest percentage. If a dealer quotes you a “5% flat rate,” the real bank rate is likely closer to 9% or 10%.

What’s Included (And What’s Not)?

To accurately determine how to calculate interest percentage on a loan, you must know what inputs to trust.

✅ Included

- Interest Actually Paid: The pure cost of borrowing.

- Loan Duration: Time is money. A 5% loan for 10 years costs more total dollars than a 5% loan for 5 years.

- Reducing Balance Logic: The fact that your principal drops every month .

❌ Excluded

- Processing Fees: These are one-time costs. While they affect the APR, they are usually not part of the pure interest rate calculation.

- Insurance (PPI): Optional add-ons should not be confused with interest.

- Penalties: Late fees are behavioral costs, not interest costs.

Step-by-Step: How to Calculate Interest Percentage Manually

You might wonder, “Why are we calculating the Flat Rate here instead of the Effective Rate?”

The reason is simple: Calculating the Effective Interest Rate (Reducing Balance) manually requires complex algebra and trial-and-error that is nearly impossible to do on a napkin. However, you can easily calculate the Flat Rate yourself to get a quick baseline estimate.

Here are the two manual workflows to find that number.

Method 1: If You Know the Total Interest (The Flat Rate approach)

Use this method if your loan statement explicitly lists “Total Finance Charge” or “Total Interest Payable.”

Step 1: Divide Total Interest by Principal Take the total interest amount and divide it by the loan amount (principal).

- Formula: Total Interest ÷ Principal Amount

- Example: $2,000 ÷ $20,000 = 0.10

Step 2: Annualize the Ratio Divide the result from Step 1 by the loan duration in years.

- Formula: Result ÷ Loan Years

- Example: 0.10 ÷ 2 Years = 0.05

Step 3: Convert to Percentage Multiply by 100 to get the percentage.

- Result: 5% Flat Rate

(Note: This is the simple rate. The real effective banking rate will be higher due to the reducing balance).

Method 2: If You Know the Monthly Payment (The Total Cost approach)

Use this method if you only see your monthly payment deduction and want to uncover the annual interest percentage.

Step 1: Calculate Total Payment Multiply your Monthly Payment by the total number of months (Tenure).

- Formula: Monthly Payment × Total Months

- Example: $500 × 60 Months = $30,000 Total Payment

Step 2: Find Total Interest Subtract the Principal (amount borrowed) from the Total Payment.

- Formula: Total Payment – Principal Amount

- Example: $30,000 – $20,000 = $10,000 Interest

Step 3: Apply the Flat Formula Now take the result from Step 2 and apply the logic from Method 1.

- Calculation: ($10,000 ÷ $20,000) ÷ 5 Years = 0.10

- Result: 10% Flat Rate

💡 Pro Tip: To estimate the Effective Interest Rate (which is what banks use), multiply your Flat Rate result by 1.8.

Example: 10% (Flat) × 1.8 = 18% (Approximate Effective Rate).

Example Calculations with Interpretation

To truly master how to calculate interest percentage on a loan, let’s look at three real-world scenarios using the two distinct paths available in our calculator.

Example A: You Know the Total Interest (The Transparent Loan)

Scenario: You are taking a student or personal loan. The agreement states you will borrow $10,000 and pay back a total of $11,616 over 3 years. You want to find the Effective Interest Rate.

- Your Data: You have the Total Interest amount of $1,616.

- Calculator Input: You enter a Principal of $10,000, a Duration of 3 Years, and the Total Interest of $1,616.

Calculator Result:

- Effective Interest Rate: 10.00%

- Verdict: Your manual “napkin math” might suggest a rate of only 5.4% ($1,616 ÷ $10k ÷ 3 years). However, the calculator reveals the Effective Interest Rate is actually 10.00%. This confirms the lender is charging interest on a standard reducing balance basis.

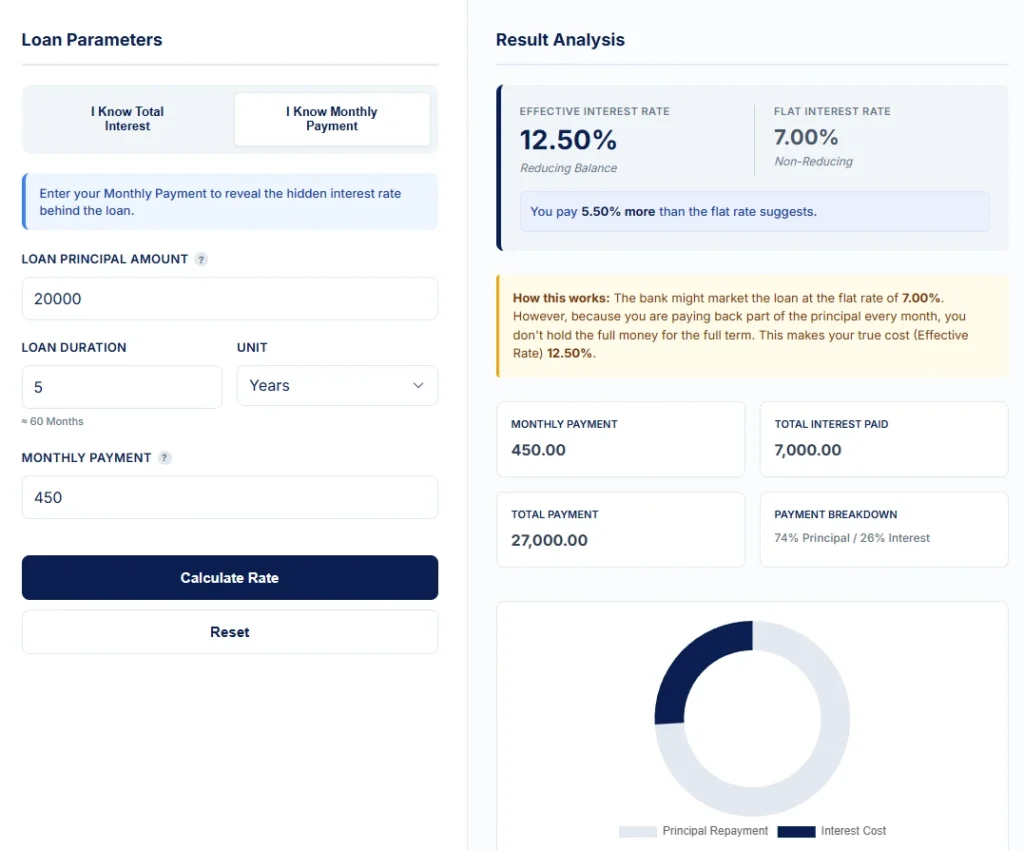

Example B: You Know the Monthly Payment (The “Flat Rate” Trap)

Scenario: You are buying a car. The dealer says, “Don’t worry about the rate, just pay $450 a month for 5 years for this $20,000 car.”

- Your Data: You only have the Monthly Payment amount of $450.

- Calculator Input: You enter a Principal of $20,000, a Duration of 5 Years, and a Monthly Payment of $450.

Calculator Result:

- Total Payment: $27,000.

- Effective Interest Rate: 12.50%

- Verdict: The dealer might have quoted a “7% flat rate” ($7,000 interest), which sounds cheap. But the calculator shows the Effective Interest Rate is nearly 13%. This proves that a low monthly payment can hide a significantly higher borrowing cost.

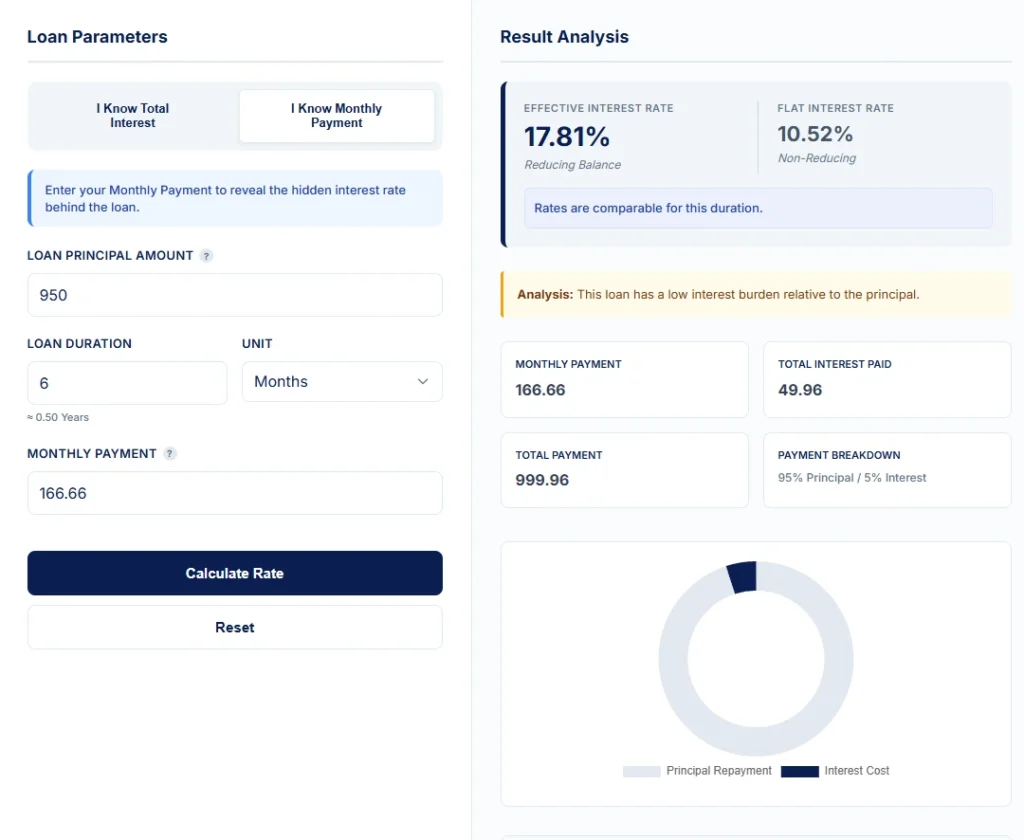

Example C: The “No-Cost” Trap (Hidden Fees)

Scenario:

You buy a laptop on a “0% interest” installment plan.

- Price: $1,000

- Tenure: 6 months

- Monthly Payment: $166.67

- The Catch: A $50 processing fee charged upfront

How to Check the True Cost:

Because the fee is deducted upfront, you only receive $950 worth of value, even though you repay $1,000. This reduces the effective principal and increases the true interest rate.

Calculator Input:

- Principal: $950

- Duration: 6 months

- Monthly Payment: $166.67

Calculator Result:

- Effective Interest Rate (Reducing Balance): ~17.81%

Verdict:

Although advertised as “0% interest,” the upfront fee creates a high implicit borrowing cost. This example shows why fees must always be considered when evaluating installment plans.

How to Use Our Interest Percentage Calculator

We have built a specific tool to help you calculate loan interest rate variables accurately without needing a manual work.

1. Choose Your Input Mode

At the top of the calculator, you will see two tabs matching the examples above:

- “I Know Total Interest”: Use this if you have a final statement showing the total interest charge .

- “I Know Monthly Payment”: Use this if you only see the monthly debit in your bank account .

2. Enter Loan Details

Input the Loan Principal Amount (e.g., 50000) and the Loan Duration . You can toggle between Years or Months depending on your contract .

3. Click Calculate

The tool will instantly process the numbers and display:

- Effective Interest Rate: The true reducing balance percentage .

- Flat Interest Rate: The nominal simple percentage .

- Payment Breakdown: A chart showing how much of your money is going toward the principal vs. interest .

Interpretation Guide (What Your Interest Percentage Means)

Once you calculate an annual interest percentage, interpret it relative to the loan type, risk level, and market conditions.

| Interest % Range | Verdict | What It Typically Indicates |

| 0% – 3% | Promotional | Subsidized or promotional offers (manufacturer or government-backed loans). Often time-limited or fee-adjusted. |

| 4% – 8% | Low | Competitive rates for secured loans such as mortgages or auto loans in favorable market conditions. |

| 9% – 15% | Moderate | Common for personal loans, used car loans, or borrowers with average credit profiles. |

| 16% – 24% | High | Expensive credit, including unsecured loans and some credit cards. Increases long-term cost significantly. |

| 25% and above | Very High | Very costly borrowing. Often associated with credit cards, short-term financing, or high-risk lending. Use cautiously. |

Note: Interest ranges vary by country, lender, credit profile, and market conditions. Always compare offers within the same loan category.

Interest Percentage vs. Advertised Loan Rate

The biggest confusion when you calculate interest rate from total interest paid is the difference between what you calculate and what the bank advertises.

| Feature | Advertised Rate (APR) | Calculated Flat % |

| Basis | Reducing Balance (Principal drops) | Original Principal (Constant) |

| Accuracy | High (True cost of funds) | Low (Estimate only) |

| Value | Usually looks Higher | Usually looks Lower |

| Best For | Comparing Bank Offers | Quick napkin math |

Frequently Asked Questions (FAQ)

Summary

Understanding how to calculate interest percentage on a loan gives you power over your debt. It prevents you from being fooled by “low monthly payments” that mask a high interest rate.

- The Goal: Find the Effective Interest Rate, not just the Flat Rate.

- The Tool: Use our calculator above to swap between Monthly Payment mode and Total Interest mode depending on what data you have .

- The Reality: Always compare the actual interest rate on loan offers, not just the monthly installment amount.

Next time a lender quotes you a number, run it through the calculator. If the math doesn’t match, ask questions.

Beyond the Month: Critical Calculations You Must Know

Once you master the monthly figures, you need to zoom out to see the bigger picture. Use these guides to find the “Sticker Price” of your loan and the “True Speed” of your wealth growth.

1. How to Calculate Total Interest Paid While your Monthly Payment covers the now, the Total Interest Paid reveals the shocking lifetime cost of your loan. Use our Total Interest Calculator to see exactly how much extra you are paying over the principal amount before you sign.

2. How to Calculate Real Interest Rate The bank’s advertised rate doesn’t account for inflation eating away at your profits. Learn how to calculate the Real Interest Rate to discover if your investments are actually building wealth or just keeping pace with inflation.

3. How to Calculate Interest Amount Per Month Your monthly payment stays the same, but the interest portion drops every single month. Use our guide on How to Calculate Interest Amount Per Month to see the exact breakdown of how much of your money goes to the bank versus paying off your debt.

Disclaimer

The information provided in this article and via the calculator is for educational purposes only and does not constitute professional financial advice. Banking regulations and loan interest percentage calculation standards vary by country. Always consult with a qualified financial advisor before signing a loan agreement.