How to Calculate Operating Income, Operating Income Percentage, and Operating Margin

If you want to understand the true core profitability of a business, you have to look beyond the top-line sales. Whether you are running a small business, analyzing stocks, or managing a corporate department, learning how to calculate operating income is one of the most valuable financial skills you can master.

Why is this specific metric so important? Unlike Net Income, which gets muddied by taxes and one-time financial events, operating income tells you exactly how much money the business makes from its actual day-to-day operations. This is why investors, managers, and analysts in the USA, UK, India, and beyond rely on it to gauge management efficiency.

In this guide, we will break down the formula, explain how to calculate operating income, and look at the operating income percentage (often called operating margin) to see how efficient a company truly is.

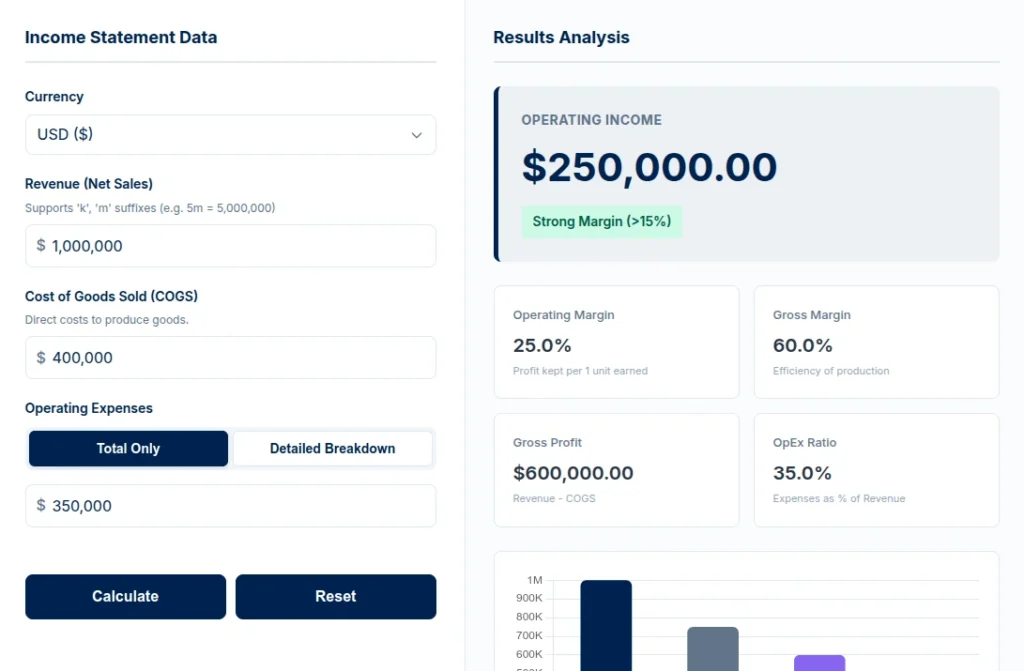

Want to skip the manual math, you can use the free operating income calculator below to get instant results, including a visual chart of your data.

Operating Income Calculator

- How to Calculate Operating Income, Operating Income Percentage, and Operating Margin

- What Is Operating Income?

- Why Operating Income Matters

- What’s Included in Operating Income

- What Operating Income Excludes

- Operating Income Formula

- Step-by-Step: How to Calculate Operating Income

- Example Calculations with Interpretations

- How to Use our Operating Income Calculator

- Interpretation Guide

- Industry Benchmarks

- Operating Income vs. EBIT vs. EBITDA vs. Net Income

- Frequently Asked Questions

- Summary

- Disclaimer

What Is Operating Income?

Operating income is the amount of profit realized from a business’s operations after deducting operating expenses such as wages, depreciation, and cost of goods sold (COGS).

Think of it as the profit generated from the “meat and potatoes” of the business. It sits right in the middle of the Income Statement—below Gross Profit but above Net Income.

According to Investopedia, operating income represents the profit a company earns from its core operations, excluding deductions of interest and taxes. It answers the question: Is the core business model actually working?

Why Operating Income Matters

Net income (the “bottom line”) can be deceiving. A company might look profitable because they sold a piece of land or had a one-time tax break, not because they sold more products.

Knowing how to calculate operating income matters because:

- It Measures Core Profitability: It strips away financial engineering to show if the product/service is actually profitable.

- It Facilitates Comparisons: It allows you to compare a company in New York with one in London, even if their tax jurisdictions differ.

- It’s More Reliable: It is less volatile than Net Income, making it better for trend analysis.

If you also want to understand how direct costs affect this number, you can read our guide on How to Calculate Cost of Goods Sold.

What’s Included in Operating Income

To accurately figure out how to calculate operating income, you need to know exactly what goes into the “Operating Expenses” bucket. These expenses may vary slightly by industry, but the core formula generally includes:

- Revenue (Net Sales): The total money coming in from sales.

- Cost of Goods Sold (COGS): Direct costs tied to production (raw materials, direct labor).

- Selling, General, and Administrative (SG&A):

- Rent and Utilities.

- Marketing and Advertising costs.

- Employee Salaries and Wages (non-production).

- Depreciation & Amortization: The gradual expensing of assets like machinery or software.

- R&D Expenses: Research and development costs.

What Operating Income Excludes

Equally important is knowing what not to touch. If you include these items, you aren’t calculating operating income anymore—you’re calculating Net Income.

Do NOT include:

- Interest Expenses: Debt payments are a financing decision, not an operational one.

- Income Taxes: These are statutory requirements.

- Investment Income: Money made from stocks or dividends.

- One-time Extraordinary Items: Lawsuit settlements or gains from selling assets.

Operating Income Formula

Here are the core formulas you need. This section is formatted for quick reference.

1. The Main Formula

Operating Income = Revenue – Cost of Goods Sold (COGS) – Operating Expenses

2. The Gross Profit Method

Operating Income = Gross Profit – Operating Expenses

3. Operating Income Percentage (Operating Margin)

Operating Income Percentage = (Operating Income ÷ Revenue) × 100

Step-by-Step: How to Calculate Operating Income

If you are doing this manually, follow this logical flow. This calculation method is universally recognized under GAAP and IFRS accounting standards.

Step 1: Determine Net Revenue

Start with your total sales. If you had returns or discounts, subtract them to get Net Revenue.

Step 2: Subtract COGS

Take your Net Revenue and subtract the Cost of Goods Sold. The result is your Gross Profit.

Step 3: Sum up Operating Expenses (OpEx)

Add up all your overheads: rent, marketing, salaries, utilities, and depreciation. Do not include interest or taxes here.

Step 4: Subtract OpEx from Gross Profit

Take the Gross Profit from Step 2 and subtract the total OpEx from Step 3. The result is your Operating Income.

Step 5: Calculate Operating Income Percentage

To see this as a ratio, divide the Operating Income by the total Revenue and multiply by 100.

Tip:Understandinghow to calculate operating incomecorrectly helps you avoid misreading profit signals. If you include tax here, your analysis will be wrong.

Example Calculations with Interpretations

To help you visualize this, let’s look at practical examples of how to calculate operating income in different industries, including a scenario where a business is losing money.

Example A: The Clothing Retailer (Healthy Margin)

Scenario: High COGS, Moderate OpEx

| Item | Amount |

| Revenue | $1,000,000 |

| (-) COGS | $400,000 |

| = Gross Profit | **$600,000** |

| (-) Expenses | $350,000 (Rent/Staff) |

| = Operating Income | **$250,000** |

| Operating Margin | 25% |

Interpretation: This company has a healthy 25% margin. For every $1 of clothes sold, they keep $0.25 after paying for the clothes and the store operations. They have plenty of room to pay taxes and interest.

Example B: The Car Factory (Volume Business)

Scenario: Very High COGS, High Depreciation

| Item | Amount |

| Revenue | $5,000,000 |

| (-) COGS | $3,500,000 |

| = Gross Profit | **$1,500,000** |

| (-) Expenses | $1,000,000 (Utilities/Depreciation) |

| = Operating Income | **$500,000** |

| Operating Margin | 10% |

Interpretation: A 10% margin is typical for heavy manufacturing. While the percentage is lower than the retailer, the raw dollar amount ($500k) is high because of the volume. Efficiency is key here; a small rise in material costs could wipe out profits.

Example C: The SaaS Company (High Efficiency)

Scenario: Low COGS, High OpEx

| Item | Amount |

| Revenue | $2,000,000 |

| (-) COGS | $200,000 (Hosting) |

| = Gross Profit | **$1,800,000** |

| (-) Expenses | $1,200,000 (Dev Salaries/Ads) |

| = Operating Income | **$600,000** |

| Operating Margin | 30% |

Interpretation: This shows the power of software. Despite high salaries, the low cost of “goods” (hosting) allows for a massive 30% operating income percentage. This business is highly scalable.

Example D: The Struggling Startup (Negative Income)

Scenario: High Expenses exceeding Gross Profit

| Item | Amount |

| Revenue | $100,000 |

| (-) COGS | $40,000 |

| = Gross Profit | **$60,000** |

| (-) Expenses | $70,000 (Marketing/Rent) |

| = Operating Income | **-$10,000** |

| Operating Margin | -10% |

Interpretation: This calculation results in a negative number. If a company has revenue of $100,000, a COGS of $40,000, and operating expenses of $70,000, the operating income becomes –$10,000. This means the core business is losing money on every sale, likely due to overspending on marketing or rent relative to their sales volume.

How to Use our Operating Income Calculator

We have built a flexible tool above to help you find these numbers instantly. Here is a quick guide on how to use it:

- Select Currency: Start by choosing your preferred currency (USD, EUR, GBP, INR, or JPY).

- Enter Revenue: Input your Net Sales. You can use shortcuts like “5m” for 5 million or “10k” for 10,000.

- Enter Cost of Goods Sold (COGS): Input the direct costs associated with production.

- Choose Expense Mode:

- Total Only: If you know your total overheads, click “Total Only” and enter the single figure.

- Detailed Breakdown: To see exactly where money is going, click “Detailed Breakdown.” This opens fields for Salaries, Rent & Utilities, Marketing, and Other Expenses.

- Analyze Results: Click “Calculate.” The tool will display your Operating Income, Gross Profit, and key ratios like the OpEx Ratio.

- Visuals & Print: A dynamic chart will generate to show your cost breakdown. You can also click “Print Report” to generate a clean PDF summary.

Interpretation Guide

Once you know how to calculate operating income, the next step is understanding what the number implies for your strategy.

High Operating Income

A positive, high operating income (typically >15%) indicates strong pricing power and efficient cost management. The business keeps a large chunk of every dollar earned and has a “safety cushion” against economic downturns.

Low Operating Income

A low percentage (<5%) suggests the business runs on thin margins. This isn’t always bad (grocery stores run lean), but it is risky. A small drop in sales or a minor rise in rent could push the company into a loss.

Operating Loss

If the calculation is negative, the business model is currently unsustainable. It implies that the cost of running the business exceeds the profit generated from sales. Immediate action is needed to either raise prices, cut COGS, or reduce overheads.

Industry Benchmarks

When analyzing your “operating income percentage,” context is king.

- Retail/Grocery: Typically low (2% – 6%). They rely on high volume.

- Manufacturing: Moderate (8% – 15%). Heavy reliance on machinery costs.

- SaaS/Software: High (20% – 40%). Selling extra software copies costs very little.

- Consulting/Services: Moderate to High (15% – 25%). Main costs are people.

Operating Income vs. EBIT vs. EBITDA vs. Net Income

- Operating Income vs. EBIT: Usually the same for small businesses. EBIT technically includes non-operating investment income, while Operating Income strictly excludes it.

- Operating Income vs. EBITDA: EBITDA adds back Depreciation. If you have heavy machinery, Operating Income will be much lower than EBITDA.

- Operating Income vs. Net Income: Net Income is the final bottom line after taxes and interest. Operating income is the profit before the government and lenders get paid.

Frequently Asked Questions

Summary

Learning how to calculate operating income is the first step toward true financial literacy. It separates the money you make from the core business from the noise of taxes and one-time events. By monitoring your operating income percentage, you can make smarter decisions about pricing, staffing, and expansion.

Ready to crunch the numbers? Scroll up and use the Operating Income Calculator to get your financial health check in seconds.

Disclaimer

This content and the accompanying calculator are for educational and informational purposes only. Financial figures and ratios can vary based on specific accounting standards. Please consult with a qualified financial advisor or accountant for professional advice regarding your business finances.