How to Calculate Paying Off a Mortgage Early

A mortgage looks simple on paper. You borrow money, make a fixed payment every month, and eventually, the loan ends. But in reality, most homeowners pay far more interest than the house price itself. Banks and lenders rely on one thing: time. The longer your loan runs, the more interest you hand over. That is why lenders rarely explain how small changes like extra payments or biweekly schedules can cut years off your mortgage.

The rules are the same everywhere—whether you are in the United States, the UK, Europe, or Australia. The math does not change. If you understand the mechanics of compound interest, you can turn the tables on the lender.

In this guide, you will learn how to calculate paying off a mortgage early, understand the formulas behind it, see real examples, and use our free pay off mortgage early calculator to test different strategies instantly. We will break down the numbers so you can decide which path—monthly extras, biweekly shifts, or lump sums—saves you the most money.

Ready to see the numbers in real time?

Try the Pay Off Mortgage Early Calculator below and compare strategies instantly.

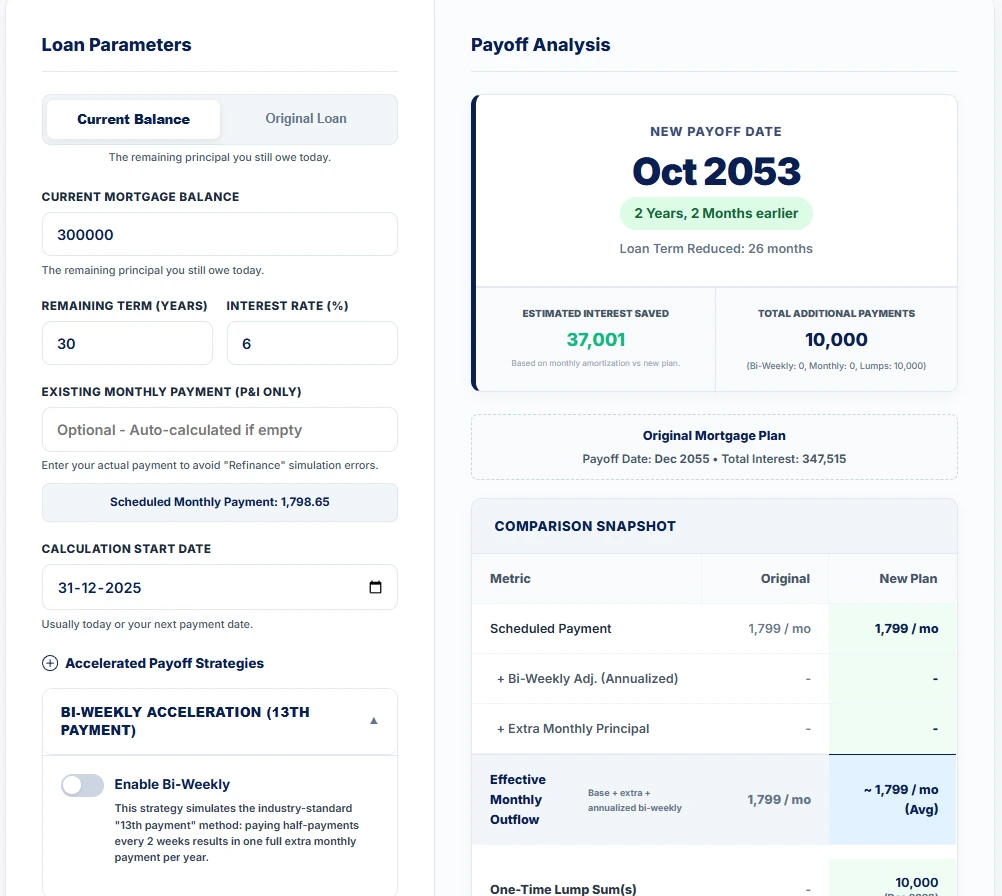

Pay Off Mortgage Early Calculator

Loan Parameters

Payoff Analysis

Balance Reduction Over Time

- How to Calculate Paying Off a Mortgage Early

- What Does Paying Off a Mortgage Early Mean?

- Why Paying Off a Mortgage Early Matters

- How Mortgage Interest Really Works

- Standard Mortgage Payment Formula

- How to Calculate Paying Off a Mortgage Early

- Step-by-Step: How to Calculate Mortgage Payoff Early Manually

- Example Calculations

- Comparison Table: Mortgage Payoff Strategies

- Interpretation Guide: What the Results Mean

- How to Use Our Payoff Mortgage Early Calculator

- Common Mistakes to Avoid

- Frequently Asked Questions

- Summary

- Disclaimer

What Does Paying Off a Mortgage Early Mean?

Paying off a mortgage early means reducing the loan term by paying more principal sooner than scheduled.

When you sign a mortgage contract, you agree to a specific term (usually 15, 20, or 30 years). The lender creates an amortization schedule based on that timeline. However, you are rarely locked into that timeline permanently. By accelerating the payoff, you are essentially “buying back” time from the bank.

This can happen through:

- Extra monthly payments: Adding a set amount to your regular bill.

- Biweekly payment strategy: Splitting payments to create an extra yearly installment.

- Lump sum payments: Using windfalls like bonuses to slash the balance.

- A combination of all three: An aggressive approach to debt freedom.

The key idea is simple: Interest is calculated on the remaining balance. Reduce the balance faster, and the interest charged in the following month collapses. This creates a snowball effect where more of your standard payment goes toward principal in every subsequent month.

Why Paying Off a Mortgage Early Matters

Most homeowners focus only on the monthly payment amount. That is exactly what banks want. They want you to look at the short-term cost rather than the long-term price of the loan.

Learning how to calculate paying off a mortgage early matters because it shifts your perspective from “monthly survival” to “total wealth.”

Here is why accurate calculation is vital:

- Reveals Real Savings: It reveals how much interest saved you can realistically achieve. We aren’t talking about small change; for many, this is the equivalent of a retirement fund.

- Time Recovery: It shows how many years you can cut from the loan. Imagine not having a housing payment 5 or 7 years earlier than planned.

- Strategy Comparison: It helps compare strategies instead of guessing. Is it better to pay 100 extra a month or drop 5,000 once a year? Calculation gives the answer.

- Prevents Emotion-Based Errors: It prevents overpaying due to emotional decisions. Sometimes, investing is better than paying off a cheap loan. You need the numbers to decide.

- Control: It gives control back to the borrower. You stop being a passive payer and become an active manager of your debt.

Even small extra payments can have a massive compounding effect over decades. A mortgage early payoff calculation often surprises people by showing that a mere 10% increase in payment can shave years off the term.

How Mortgage Interest Really Works

To understand how to calculate paying off a mortgage early, you must first understand how the bank calculates your bill.

Mortgage interest is calculated based on three variables:

- Remaining mortgage balance (The principal).

- Interest rate (The annual cost of borrowing).

- Time (The duration you hold the money).

The Amortization Trap

At the start of the loan, your balance is high. Therefore, the interest charge is high.

- Early Years: Most of your payment goes to interest. Very little reduces the balance.

- Later Years: The balance is lower, so the interest portion shrinks. Principal reduction accelerates.

This is why early extra payments are dramatically more powerful than late ones. A dollar paid extra in year one prevents 29 years of interest accumulation on that dollar. A dollar paid extra in year 29 only saves one year of interest.

Standard Mortgage Payment Formula

Standard Mortgage Payment Formula

To calculate a regular monthly mortgage payment, lenders use a globally accepted formula. While most homeowners rely on a mortgage calculator, understanding the formula helps clarify how loan amount, interest rate, and loan duration work together.

The fixed monthly payment formula is:

M = P × [ r(1 + r)^n ] / [ (1 + r)^n − 1 ]Where:

- M = Monthly mortgage payment

- P = Loan amount (principal)

- r = Monthly interest rate (annual interest rate ÷ 12)

- n = Total number of payments (loan term in years × 12)

This formula produces a fixed monthly payment, but the interest portion is not fixed. In the early years, a larger share of each payment goes toward interest. Over time, the principal portion increases while interest decreases.

How to Calculate Paying Off a Mortgage Early

There are three primary methods used worldwide to accelerate a mortgage. When you ask, “how fast will i pay off my mortgage?” the answer depends on which of these levers you pull.

Method 1: Extra Monthly Payments

This is the most common approach. You add a fixed amount to your regular payment every month. You instruct the lender to apply this excess specifically to the principal.

Effect:

- Direct principal reduction: The balance drops immediately.

- Faster balance decline: The next month’s interest is calculated on a lower number.

- Large interest savings: Over time, this cuts the tail end of the loan off.

This is the most predictable and controllable strategy. You can start with a small amount and increase it as your income grows.

Method 2: Biweekly Payment Strategy

This is a popular “hack” that works simply by changing the calendar. Instead of paying monthly (12 payments a year), you pay half the monthly payment every two weeks.

The Math Behind It:

There are 52 weeks in a year.

52 weeks ÷ 2 = 26 half-payments = 13 full monthly payments

By doing this, you accidentally make one extra full payment annually without feeling the pinch in your monthly budget.

Important note: This method is mathematically similar to adding one extra payment per year divided by 12, even though it feels different operationally. Our biweekly mortgage payments calculation tool handles this logic automatically.

Method 3: Lump Sum Payments

You make one-time principal reductions using irregular income. This might come from work bonuses, tax refunds, an inheritance, or selling another asset.

Effect:

- Immediate Drop: The principal balance takes a sharp dive.

- Permanent Interest Reduction: Every month after the lump sum, the interest portion of your regular payment is lower than it would have been.

Timing matters more than size here. Effective mortgage acceleration planning involves knowing that a lump sum in year 2 is worth much more than the same lump sum in year 20.

Step-by-Step: How to Calculate Mortgage Payoff Early Manually

If you want to understand the logic without a computer, here is the manual workflow. This answers the question: “how do i calculate paying off mortgage early on my own?”

Step 1: Calculate Your Regular Monthly Payment Use the standard mortgage formula or look at your loan contract to find your required Principal + Interest payment. (Do not include taxes or insurance in this calculation, as those don’t affect the loan payoff speed).

Step 2: Decide the Acceleration Method Choose your fighter: Are you adding a set monthly amount? Are you switching to biweekly? Or are you dropping a lump sum?

Step 3: Apply Extra Payments to Principal Take your current loan balance. Calculate one month of interest:

(Balance × Annual Rate) ÷ 12 = Monthly Interest

Subtract that interest from your total payment (Regular + Extra). The remainder goes to the principal.

Total Payment – Monthly Interest = Principal Reduction

Step 4: Recalculate Remaining Balance Subtract the Principal Reduction from the previous Balance. This is your new remaining mortgage balance.

Step 5: Track New Payoff Date and Interest Repeat this process for every month until the balance hits zero. Count the number of months it took. Compare this against your original term (e.g., 360 months). The difference is your time saved.

Example Calculations

To truly understand how to calculate paying off a mortgage early, it helps to look at concrete scenarios. The following examples use a currency-neutral baseline (the math is identical whether you use Dollars, Pounds, or Euros).

Baseline Loan Scenario:

- Loan Amount: 300,000

- Interest Rate: 6.0%

- Term: 30 Years

- Standard Scheduled Payment: 1,799

Example 1: Extra Monthly Payment

The Strategy: You budget to pay an extra 200 per month starting immediately.

- New Monthly Outflow: ~1,999

- Loan Term Reduced: 6 Years and 9 Months (81 months)

- Interest Saved: 91,174

Interpretation: By increasing the monthly outflow by a relatively small amount, the loan is finished nearly 7 years ahead of schedule. The 91,174 in interest savings represents money that remains with the homeowner rather than the lender. In the final years of the original term, this frees up the entire monthly payment amount for other financial goals.

Example 2: Biweekly Payment Strategy

The Strategy: You switch to paying half of the monthly amount (~900) every two weeks.

The Math: Because there are 52 weeks in a year, this results in 26 half-payments. This equals 13 full payments per year—effectively making one extra full payment annually without changing the monthly budget significantly.

- Loan Term Reduced: ~5 Years 5 months (65 months)

- Interest Saved: ~73,667

Interpretation: This method is effective because it accelerates the payoff largely unnoticed. It relies on the frequency of payments rather than a drastic change in spending habits, saving five years of payments simply by aligning the schedule with a biweekly income cycle.

Example 3: Lump Sum Payment

The Strategy: You keep your standard payment, but make a single 10,000 lump sum payment at the start of Year 3.

- Loan Term Reduced: ~2 Year and 2 Months (26 months)

- Interest Saved: ~37,000

Interpretation: This scenario highlights the importance of timing. Because the principal is reduced early in the loan term (Year 3), interest stops accruing on that portion of the debt for the remaining 27 years. A one-time action eliminates more than two years of future mortgage obligations. If the same payment were made later in the loan term, the interest savings would be significantly lower.

Comparison Table: Mortgage Payoff Strategies

When figuring out how to pay off your mortgage faster, you can use this table to choose the method that fits your lifestyle.

| Strategy | Payment Change | Effort Level | Interest Saved | Best For |

| Extra Monthly | Small monthly increase | Medium | Very High | Those with stable income and discipline |

| Biweekly | Same payment feeling | Low | High | Salary-based households paid every 2 weeks |

| Lump Sum | Irregular | Variable | High if early | People with bonuses, commissions, or savings |

| Combined | Flexible | Medium | Maximum | Aggressive payoff goals and early retirement |

Interpretation Guide: What the Results Mean

When you use a mortgage early payoff tool to explore early repayment, several results are displayed. Here’s how to understand each one..

Years Reduced

This is the headline number. It shows how much earlier you become debt-free. If the result says “5 Years Saved,” that is 60 months where you will keep 100% of your income instead of giving it to the bank.

Interest Saved

This represents money never paid to the lender. It is “phantom income”—money you kept in your pocket. This is often the most motivating factor in a mortgage payoff formula.

Effective Monthly Outflow

If you choose the biweekly method, your monthly cash flow changes slightly (some months you pay three times, others two). The “Effective Monthly Outflow” averages this out so you can judge affordability against your monthly budget.

Remaining Balance Curve

On an amortization schedule chart, you want to see the curve dip steeply. A steep drop early means strong acceleration. If the line is flat, you are paying mostly interest.

How to Use Our Payoff Mortgage Early Calculator

We have provided a powerful, custom-built calculator to help you handle the complex math. Here is a guide on how to calculate paying off a mortgage early using this specific tool.

Mode 1: Current Balance (For Existing Loans)

If you have been paying your mortgage for a few years, use this mode.

- Select “Current Balance”: This allows you to start from where you are today, not 10 years ago.

- Enter Current Mortgage Balance: Look at your latest bank statement for the exact principal remaining.

- Enter Remaining Term: How many years are left on your contract?

- Enter Interest Rate: Your current annual rate.

- Existing Monthly Payment: The calculator can estimate this, but for the best accuracy, enter exactly what you are mandated to pay (Principal + Interest only).

Mode 2: Original Loan (For New Loans or Research)

Use this if you are planning a new mortgage or want to see how a loan looks from day one.

- Select “Original Loan”: This simulates the loan from the very first payment.

- Enter Original Loan Amount: The total amount you borrowed.

- Enter Original Term: Usually 20, 25, or 30 years.

- Enter Start Date: When the loan began.

Applying Strategies

Once your base data is in, use the “Accelerated Payoff Strategies” section to answer how to pay off a mortgage faster:

- Bi-Weekly Acceleration: Toggle this switch to simulate the “pay half every two weeks” method. The tool calculates the 13th payment effect automatically.

- Extra Monthly Payment: Enter an amount (e.g., 100 or 500) to see how consistent overpayment slashes the term. You can also pick a “Start Date” to simulate starting extra payments in the future.

- One-Time Lump Sums: This dynamic list allows you to add specific payments. Did you get a bonus three years ago? Or do you plan to sell a car next year? Add these distinct payments to see their specific impact on your mortgage interest savings calculation.

Click “Calculate” to generate the results, visuals, and the summary of time and money saved.

Common Mistakes to Avoid

Even when you understand early mortgage payoff concepts, incorrect execution can reduce the expected savings.

- Not Specifying “Principal Only”: When sending extra money, you must tell the lender it is for the “Principal.” Otherwise, some lenders effectively prepay the next month’s interest, which defeats the purpose.

- Starting Too Late: While it is never too late, the math favors early action. Waiting 10 years to start paying extra reduces the impact significantly.

- Ignoring Prepayment Penalties: Some fixed-rate loans have fines if you pay them off too fast. Always check your contract.

- Comparing Strategies Without a Baseline: You cannot know if a strategy is good unless you compare it to the standard plan. Always calculate the “do nothing” scenario first.

- Stretching Too Thin: Don’t commit to a mortgage early payoff calculation that leaves you with zero cash for emergencies. House rich and cash poor is a dangerous place to be.

Frequently Asked Questions

Summary

Knowing how to calculate paying off a mortgage early changes how you view your debt. You stop seeing a monthly bill and start seeing a mathematical puzzle that you can solve.

- Interest depends on time and balance: Reduce either, and you win.

- Small early actions create massive long-term savings: You don’t need to double your payment to see results.

- Strategy matters: Whether you use biweekly mortgage payments calculation or lump sums, consistency is key.

You now have the knowledge and the mortgage early payoff calculation tools to make an informed decision. Use the calculator above to test different scenarios before making real financial moves. Experiment with the numbers—add a small monthly extra, throw in a theoretical lump sum—and watch how the payoff date moves closer to today.

Disclaimer

The information provided in this article and via the calculator is for educational purposes only and does not constitute professional financial advice. Banking rules, prepayment penalties, and tax implications vary by country and lender. Always consult with a qualified accountant or financial advisor regarding your specific business and personal financial situation.