How to Calculate Real Interest Rate Formula, Examples and Free Calculator

Imagine you deposit $10,000 into a savings account that promises a 5% annual return. On paper, this looks like a solid deal. At the end of the year, you have $10,500. You made $500, right? Not necessarily. If the prices of groceries, gas, and rent increased by 6% during that same year, your money actually lost value. You have more dollars, but you can buy less with them than you could twelve months ago.

This is the classic trap of looking only at the “nominal” interest rate—the number the bank advertises. To understand if your wealth is actually growing, you need to look deeper. You need to account for inflation. This requires understanding how to calculate real interest rate figures effectively.

The real interest rate is the single most important number for savers and investors because it reveals the truth about your purchasing power. It strips away the illusion of inflation to show you exactly how much richer—or poorer—you are becoming over time.

In this comprehensive guide, we will break down the concept of purchasing power, explain the difference between nominal and real rates, and show you exactly how to calculate real interest rate using both the simple formula and the precise Fisher Equation. We have also included a free calculator below to help you run the numbers instantly.

Real Interest Calculator

Market Parameters

Analysis Result

Real Interest Rate

Visual Breakdown

- How to Calculate Real Interest Rate Formula, Examples and Free Calculator

- Real Interest Calculator

- What Is the Real Interest Rate?

- Understanding Purchasing Power and Inflation

- Why the Real Interest Rate Is Important

- Real Interest Rate Formula

- How to Calculate Real Interest Rate Step by Step

- Real Interest Rate Examples (With Interpretation)

- How to Use Our Real Interest Rate Calculator

- How to Interpret Your Real Interest Rate Result

- Real Interest Rate vs Nominal Interest Rate

- Real World Cost of Living Example

- Frequently Asked Questions (FAQ)

- Summary

- Related Calculators

- Disclaimer

What Is the Real Interest Rate?

The real interest rate is an interest rate that has been adjusted to remove the effects of inflation. It represents the true cost of funds to the borrower and the real yield to the lender or investor.

When you see an advertised rate on a car loan, a mortgage, or a high-yield savings account, you are looking at the “nominal” interest rate. The nominal rate tells you how many dollars you will earn (or pay) in the future. However, it does not tell you what those dollars will be worth when you get them.

The real interest rate meaning boils down to purchasing power. If you earn 5% interest, but inflation is 4%, your real interest rate is only about 1%. That 1% represents the actual increase in goods and services you can buy with your savings.

This metric is commonly used in various areas of finance:

- Savings: Determining if a bank account acts as a true store of value.

- Bonds: Analyzing the actual return on fixed income investments (like TIPS – Treasury Inflation-Protected Securities).

- Loans: Understanding the true cost of borrowing money for a house or business.

- Long-term Planning: Estimating how much a retirement fund will truly be worth in twenty or thirty years.

Understanding Purchasing Power and Inflation

To fully grasp the calculation, you first need to understand the relationship between money and goods. This is known as purchasing power. Purchasing power is the quantity of goods or services that one unit of currency can buy.

Inflation is the rate at which the general level of prices for goods and services is rising. As inflation rises, purchasing power falls.

Think of it this way:

Ten years ago, a cup of coffee might have cost $2.00. Today, that same cup of coffee might cost $3.50. The coffee hasn’t changed; the value of the dollar has simply decreased.

If you hid $100 under your mattress ten years ago, you still have a $100 bill today. However, you cannot buy as much with it as you could back then. Your “nominal” wealth is the same ($100), but your “real” wealth has dropped significantly. This is why growing balances do not always mean growing wealth. If your investment portfolio grows by 8% this year, but the cost of living rises by 10%, you have technically lost wealth. You are falling behind. Understanding how to calculate real interest rate is the only way to measure this “invisible” loss.

Why the Real Interest Rate Is Important

Many people ignore the real interest rate because inflation usually happens slowly. It is easy to overlook a 2% or 3% price increase from year to year. However, over a decade, these small percentages compound into massive differences in lifestyle and financial security.

Here is why this calculation matters for different groups:

- For Savers: It helps you realize if your “high-yield” savings account is actually growing your money or if it is slowly bleeding value relative to inflation.

- For Fixed Income Investors: Bond investors live on yield. If inflation spikes, the fixed payments from a bond buy less groceries and fuel. Knowing the real rate helps investors choose bonds that offer genuine protection.

- For Retirement Planning: When planning for retirement, you might project a 7% return. But if you don’t factor in inflation, your projection will be dangerously wrong. You need to project “real” returns to ensure you can afford your lifestyle in 2040 or 2050.

- For Borrowers: Interestingly, inflation helps borrowers. If you have a fixed rate mortgage at 4% and inflation jumps to 6%, the real interest rate on your debt is negative. You are paying back the bank with dollars that are worth less than the ones you borrowed.

Real Interest Rate Formula

When learning how to calculate real interest rate, you will encounter two primary methods. The method you choose depends on how much precision you need and how high the inflation rate is.

Method 1: The Simple Formula (Approximation)

For most everyday situations where inflation and interest rates are low (typically below 5% or 10%), a simple subtraction works well enough. This gives you a quick “back-of-the-napkin” estimate.

The Formula:

Real Interest Rate = Nominal Interest Rate − Inflation Rate

Why use this?

It is easy to do in your head. If your bank pays 4% and inflation is 3%, you simply subtract 3 from 4 to get a real rate of roughly 1%.

Method 2: The Fisher Equation (The Exact Method)

The simple method is technically an approximation. As rates get higher, the math becomes less accurate because it ignores the compounding effect of inflation during the period. For precise financial analysis, or during periods of high inflation (hyperinflation), you must use the Fisher Equation, named after economist Irving Fisher.

The Formula:

Real Interest Rate = [(1 + Nominal Rate) ÷ (1 + Inflation Rate)] − 1

Why use this?

This formula mathematically adjusts the principal amount for inflation before calculating the return. It provides the exact percentage change in purchasing power. While the difference between the simple method and the Fisher equation might be small at low rates (e.g., 0.1%), it becomes massive if inflation hits 20% or 50%.

How to Calculate Real Interest Rate Step by Step

Let’s walk through the process manually so you understand exactly what happens inside the calculator. We will assume you are using the exact method (Fisher Equation) for the best accuracy.

Step 1: Identify the Nominal Interest Rate

Find the advertised rate of your investment or loan. Let’s say you have a corporate bond paying 8%.

- Decimal form: 0.08

Step 2: Identify the Inflation Rate

Find the annual inflation rate (CPI) for the same period. Let’s assume inflation is running high at 5%.

- Decimal form: 0.05

Step 3: Apply the Formula

We plug these into the Fisher Equation:

- (1 + 0.08) ÷ (1 + 0.05) − 1

- 1.08 ÷ 1.05 − 1

Step 4: Perform the Division

- 1.08 divided by 1.05 equals approximately 1.02857

Step 5: Subtract 1 and Convert to Percentage

- 1.02857 − 1 = 0.02857

- Multiply by 100 to get the percentage: 2.86%

Step 6: Interpret the Result

Even though the bond pays 8%, your purchasing power is only growing by 2.86%. This is your real interest rate.

If you had used the simple method (8% – 5%), you would have calculated 3%. As you can see, the simple method slightly overestimates your return.

Real Interest Rate Examples (With Interpretation)

To fully master how to calculate real interest rate scenarios, it helps to look at different market conditions. Here are three common examples.

Example 1: The “Good Times” (Positive Real Rate)

- Nominal Rate: 7% (Stock Market Average)

- Inflation Rate: 2% (Target Inflation)

- Calculation (Simple): 7% – 2% = 5%

- Interpretation: This is a healthy scenario. Your wealth is growing significantly faster than the cost of living. You are building true long-term wealth.

Example 2: The “Stagnation” (Zero Real Rate)

- Nominal Rate: 4% (High-Yield Savings)

- Inflation Rate: 4% (Current Inflation)

- Calculation (Simple): 4% – 4% = 0%

- Interpretation: You are breaking even. You aren’t losing money, but you aren’t gaining any purchasing power either. You are simply running on a treadmill to stay in the same place.

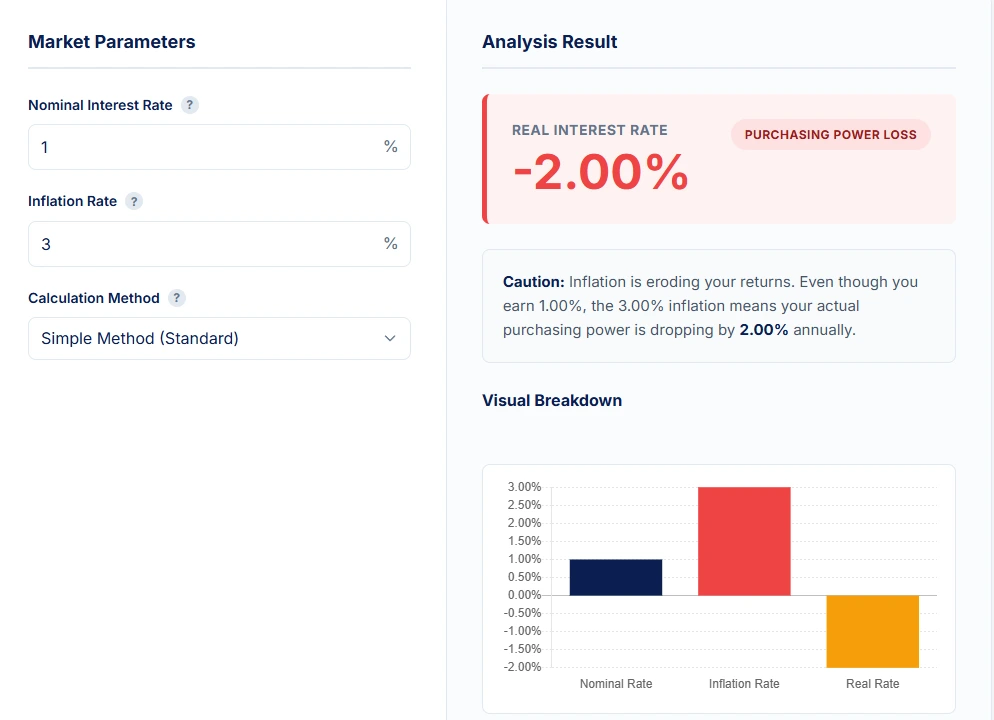

Example 3: The “Wealth Erosion” (Negative Real Rate)

- Nominal Rate: 1% (Standard Checking Account)

- Inflation Rate: 3% (Moderate Inflation)

- Calculation (Simple): 1% – 3% = -2%

- Interpretation: This is a dangerous scenario for savers. Even though your bank balance shows you earned interest, you can buy 2% less stuff than you could a year ago. If this persists for a decade, your savings will lose substantial value.

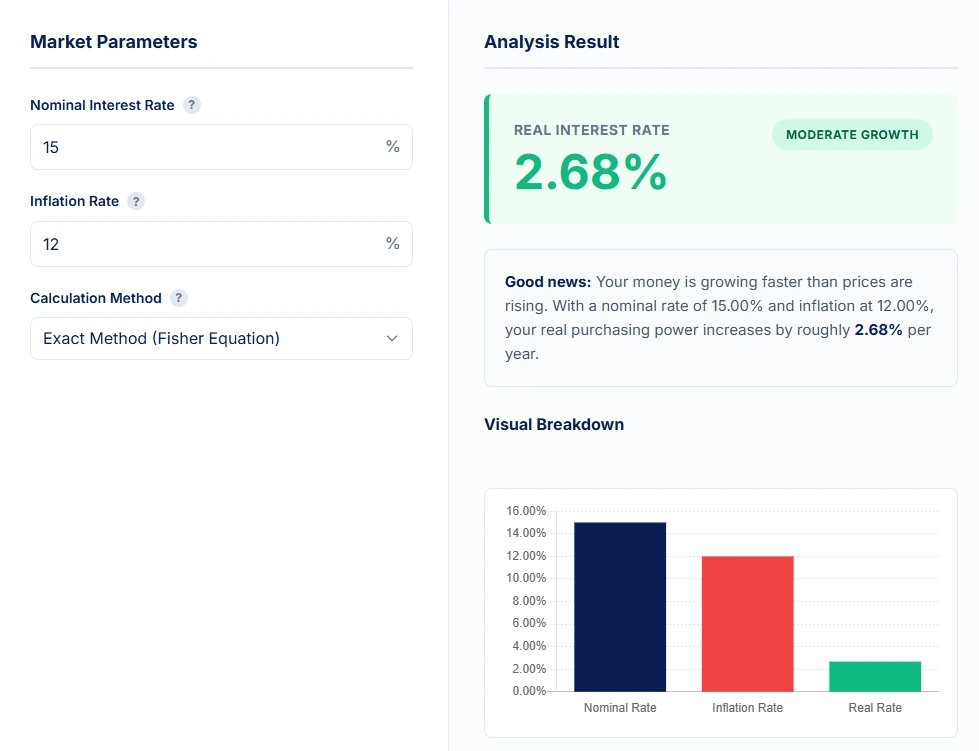

Example 4: High Inflation (Fisher Method Required)

- Nominal Rate: 15%

- Inflation Rate: 12%

- Simple Calculation: 15% – 12% = 3%

- Fisher Calculation: (1.15 ÷ 1.12) – 1 = 2.68%

- Interpretation: Notice the gap? The simple method overstates your profit. In high-inflation environments, using the exact formula is critical to avoid overestimating your financial health.

How to Use Our Real Interest Rate Calculator

We have embedded a powerful tool on this page to help you avoid manual math errors. Our calculator allows you to toggle between the Standard (Simple) method and the Exact (Fisher) method.

Here is how to use it:

1. Market Parameters

- Nominal Interest Rate: Enter the rate provided by your bank, broker, or loan agreement. This is the “face value” rate.

- Inflation Rate: Enter the expected or current inflation rate. You can find this data on government financial sites or news reports regarding the Consumer Price Index (CPI).

- Calculation Method: Choose “Simple Method” for quick estimates or “Exact Method (Fisher Equation)” for precision. We recommend the Fisher method for better accuracy.

2. Analysis Result

Once you click “Calculate,” the tool will display your Real Interest Rate.

- If the result is green, your money is growing in value.

- If the result is grey white or red, you are either breaking even or losing purchasing power.

3. Visual Breakdown

The calculator generates a bar chart comparing the Nominal Rate, Inflation Rate, and Real Rate side-by-side. This visual aid helps you instantly see how much of your nominal return is being “eaten” by inflation.

How to Interpret Your Real Interest Rate Result

Once you know how to calculate real interest rate figures, you need to know what they mean for your wallet. Our calculator categorizes the results into specific ranges to help you gauge your financial health.

Here is a general guide on how to interpret the numbers:

| Real Rate Range | Status | Interpretation |

| Above 3.00% | Strong Growth | Your investments are significantly outpacing inflation. This is ideal for wealth accumulation and retirement building. |

| 1.00% to 3.00% | Moderate Growth | A healthy range. Your money is safe and growing modestly in purchasing power. Typical for conservative bond portfolios. |

| 0.01% to 1.00% | Barely Keeping Up | You are technically making money, but the margin is very thin. A slight increase in inflation could push you into the negative. |

| 0.00% | Break Even | Your return exactly matches the cost of living increase. You are preserving capital, but not growing it. |

| Below 0.00% | Purchasing Power Loss | Risk Zone. Your money is losing value. Even if the nominal rate is positive, inflation is destroying the value of your cash faster than interest is accumulating. |

Note: These ranges are general educational guidelines. Different economic environments may change what is considered a “good” real return.

Real Interest Rate vs Nominal Interest Rate

It is easy to confuse these two terms, but the difference is critical for financial literacy.

The Nominal Interest Rate is the “price tag” of money. It is the percentage you agree to pay or receive. It does not care about the economy, the price of milk, or the cost of housing. It is a fixed number in a contract.

The Real Interest Rate is the “value” of money. It cares deeply about the economy. It tells you what that money is actually worth in the real world.

Comparison Table:

| Feature | Nominal Interest Rate | Real Interest Rate |

| Definition | The stated interest rate on a loan or investment. | The interest rate after adjusting for inflation. |

| Includes Inflation? | No. | Yes. |

| Formula | Set by the bank or market. | Nominal Rate – Inflation Rate. |

| Used For | Calculating monthly payments or interest earned. | Calculating actual purchasing power growth. |

| Can be Negative? | Rarely (in standard banking). | Frequently (when inflation > nominal rate). |

Think of the nominal rate as the speed your car speedometer shows (e.g., 60 mph). Think of inflation as a headwind blowing against you (e.g., 10 mph). The real rate is your actual speed over the ground (50 mph).

Real World Cost of Living Example

Let’s apply how to calculate real interest rate to a tangible goal: buying a car.

Suppose you want to buy a car that currently costs $20,000.

You have $20,000 in cash today, but you decide to invest it for one year in a Certificate of Deposit (CD) paying 5% nominal interest.

One Year Later:

- You have earned 5% interest ($1,000).

- Your total bank balance is $21,000.

However, inflation during that year was 6%. This means the price of cars, along with everything else, went up by 6%.

- The car that cost $20,000 last year now costs $21,200.

The Outcome:

Even though you have $1,000 more dollars than you started with, you are now $200 short of buying the car.

- Your nominal return was +5%.

- Your real return was approximately -1%.

This example proves why chasing nominal returns without considering inflation can lead to financial shortfalls. The real interest rate tells the story that the bank balance hides.

Frequently Asked Questions (FAQ)

Summary

Understanding how to calculate real interest rate is a superpower for personal finance. It prevents you from being fooled by big numbers that have little value.

- Look Beyond the Advertised Rate: The nominal rate is just the starting point. Always ask, “What is the inflation rate?”

- Purchasing Power is King: The goal of investing is not just to get more dollars, but to be able to buy more with those dollars in the future.

- Use the Right Tool: For quick estimates, subtraction is fine. For serious planning, use the Fisher Equation or the calculator provided above.

- Watch for Negatives: If your real rate is negative, your savings are shrinking in value. You may need to seek higher-yield investments to preserve your wealth.

By keeping an eye on the real interest rate, you ensure that your financial planning is grounded in reality, not just optimistic numbers.

Related Calculators

If you found this tool helpful, you might also be interested in our other financial analysis tools to get a complete picture of your business or personal finances:

- Net Income Calculator: Determine your actual profit after all expenses.

Disclaimer

The content provided in this article and the accompanying calculator is for educational and informational purposes only. It does not constitute professional financial advice, investment recommendations, or tax advice. Market parameters such as inflation and interest rates are subject to change. Please consult with a qualified financial advisor before making significant financial decisions.