How to Calculate Remaining Loan Balance Using Formula, Examples, Extra Payments, and Calculator

A loan does not decline in a straight line. If you borrow 100,000 and pay back 10,000, you might instinctively feel like you should owe 90,000. Unfortunately, financial math rarely works that simply.

Even with a fixed payment that stays the same every month, the specific amount applied toward the principal changes over time because interest is calculated on the outstanding balance. This means the amount you still owe at any point cannot be found by simply subtracting payments from the original loan.

For borrowers trying to plan their financial future, this can be confusing. You might look at a statement after three years of payments and realize the balance has barely moved. This guide explains exactly how to calculate remaining loan balance using standard financial methods, how extra payments drastically alter the math, and how to verify the results.

If you prefer not to work through the manual calculations, you can use the remaining loan balance calculator below to see the results instantly.

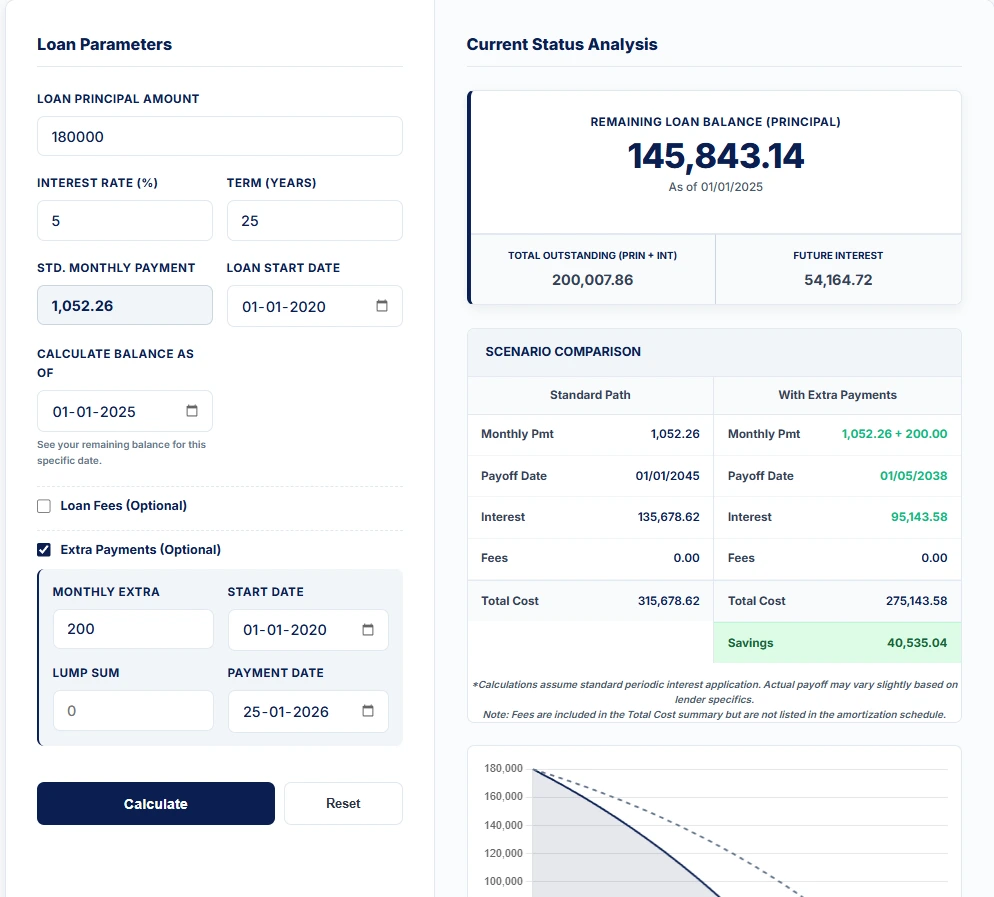

Remaining Loan Balance Calculator

Loan Parameters

Current Status Analysis

Note: Fees are included in the Total Cost summary but are not listed in the amortization schedule.

- How to Calculate Remaining Loan Balance Using Formula, Examples, Extra Payments, and Calculator

- What Is Remaining (Outstanding) Loan Balance?

- Why Remaining Loan Balance Changes Every Period

- How Remaining Loan Balance Is Calculated

- Step-by-Step: How to Calculate Remaining Loan Balance Manually

- Example Calculations With Interpretation

- How to Use the Remaining Loan Balance Calculator

- Why Two People With the Same Loan Can Owe Different Amounts

- Common Misunderstandings About Loan Balances

- Frequently Asked Questions

- Beyond this: Critical Calculations You Must Know

- Summary

- Disclaimer

What Is Remaining (Outstanding) Loan Balance?

The remaining loan balance—also called the outstanding balance or outstanding principal balance—is the unpaid principal amount left on a loan at a specific point in time, after accounting for interest and principal repayments already made.

It is crucial to distinguish this from the “total amount left to pay.” The remaining balance is the figure on which your future interest will be calculated. It is the amount lenders use for refinancing calculations, payoff quotes, and credit reporting. If you were to clear your debt today, this is roughly the amount required (excluding potential payoff fees).

Why Remaining Loan Balance Changes Every Period

Many borrowers expect their balance to drop by the same amount every period. That does not happen. In fact, on a long-term loan, the balance drops very slowly in the beginning and very quickly at the end.

This occurs because of the amortization principle:

- Interest is recalculated each period on the current balance. When the loan is new, the balance is high. Therefore, the interest charge is high.

- The interest portion is higher when the balance is large. Since your monthly payment is fixed, a large portion of that payment must go to satisfy the interest first.

- The principal portion increases only as interest decreases. As you slowly chip away at the balance, the interest charge drops, leaving more of your fixed payment to attack the principal.

As a result, early payments reduce the balance slowly, while later payments reduce it faster. This curve is why learning how to calculate remaining loan balance is essential for understanding your true financial position.

How Remaining Loan Balance Is Calculated

There are two standard ways to calculate remaining loan balance. Both are mathematically correct and widely used, but they serve different purposes depending on the complexity of your loan.

Method 1: Amortization Formula (Fixed Payment Loans)

This method is used when payments and interest are regular, unchanged, and you have never paid extra. It uses a standard annuity formula to find the present value of the remaining payments.

The Formula:

Remaining Balance = P × [ (1 + r)^n – (1 + r)^p ] / [ (1 + r)^n – 1 ]

Where:

- P = Original loan principal (The amount you borrowed)

- r = Periodic interest rate (Annual rate divided by payments per year)

- n = Total number of payments originally scheduled

- p = Payments already made

This formula is excellent for a quick snapshot, but it has a limitation: it cannot easily handle scenarios where you paid extra in June but skipped a payment in July. For that, the second method is required.

Method 2: Period-by-Period Balance Tracking

When extra payments, lump sums, or fee adjustments are involved, lenders calculate the balance sequentially. This is the “real-world” method. It works like a checkbook register, tracking the loan month by month.

Conceptual Logic:

New Balance = Previous Balance + Interest for the Period – Total Payment Made

This method mirrors how loan servicing systems work internally. It is the only accurate way to understand how to calculate remaining loan balance with extra payments, as it accounts for the exact timing of when that extra money was applied.

Step-by-Step: How to Calculate Remaining Loan Balance Manually

If you want to perform the math yourself without a tool, follow this 5-step procedure.

1. Gather Your Loan “Vitals” Before doing any math, write down the exact numbers from your contract. You need:

- Principal (P): The original loan amount (e.g., 200,000).

- Annual Rate: The interest rate per year (e.g., 6%).

- Total Term (n): The total number of months in the loan (e.g., 30 years = 360 months).

2. Calculate the Periodic Interest Rate (r) Lenders quote rates annually, but they charge interest monthly. You must convert this.

- Example: If your rate is 6%, divide by 12.

- Math: 0.06 ÷ 12 = 0.005 (This is the number you use in the formula).

3. Count the Payments Made (p) Determine exactly how many payments have cleared since the loan started.

- Example: If the loan started in January 2020 and it is now January 2025, that is exactly 5 years.

- Math: 5 years × 12 months = 60 payments made.

4. Choose Your Calculation Method

- Scenario A (Standard): If you have never paid extra, plug your numbers (r, n, and p) into the Method 1 formula above.

- Scenario B (Complex): If you made a lump sum payment two years ago, the standard formula will be wrong. You must simulate the loan month-by-month (subtracting interest from payment, reducing principal, and repeating) until you reach the current date.

5. Verify with a Calculator Manual math is prone to decimal errors. If your manual calculation says you owe 150,000, but your bank statement says 158,000, you likely missed a variable. Always double-check against a reliable tool.

Note on Using the Calculator Above: You do not need to manually count “Number of Payments Made” (Step 3) when using the calculator on this page. Simply enter your Loan Start Date and the “Calculate As Of” Date. The tool automatically calculates the exact time difference and determines the remaining balance for you.

Example Calculations With Interpretation

To truly master how to calculate remaining loan balance, it is helpful to review three specific scenarios using real numbers.

Example 1: Standard Loan (No Extra Payments)

Let’s assume a standard home or business loan where the borrower pays the exact required monthly amount.

- Loan Amount: 180,000

- Interest Rate: 5%

- Term: 25 years (300 months)

- Loan Start Date: 5 years ago (e.g., Jan 1, 2020)

- Calculate Balance As Of: Today (e.g., Jan 1, 2025)

The Result (What you see in the Calculator):

- Remaining Loan Balance: 159,445

- Total Outstanding: 252,543 (This is what you would pay if you kept the loan for the full remaining term).

Interpretation: After 5 years of steady payments, you might expect the balance to be significantly lower. However, the calculator shows you still owe 159,445.

- Why? You have only reduced the principal by roughly 20,500. The majority of your payments in these first 5 years went purely to interest. The “Total Outstanding” figure is high because it includes all the future interest you are scheduled to pay over the next 20 years.

Example 2: Loan With Regular Extra Principal Payments

This scenario uses the same loan but demonstrates the power of small, consistent habits.

- Scenario: In the “Extra Payments” section, enter 200 in “Monthly Extra”.

- Start Date: Month 1 of the loan.

The Result (Check the Comparison Table):

- Remaining Loan Balance: 145,843 (vs 159,445 standard)

- Savings (Green Row): The calculator highlights a total savings of 40,535.

Interpretation: By adding just 200/month, you have lowered your current balance by over 13,000 compared to the standard path. More importantly, look at the “Total Cost” in the Comparison Table—it drops from roughly 315,000 down to 275,143, proving that small extra payments create massive long-term wealth.

Example 3: One-Time Lump Sum Payment

Sometimes a borrower receives a bonus or tax refund and applies it all at once.

- Scenario: In the “Extra Payments” section, enter a 10,000 Lump Sum.

- Payment Date: Set this date to exactly 3 years after the loan started.

- Calculate Balance As Of: 5 years after the loan started.

The Result:

- Remaining Loan Balance: 148,395

Interpretation: Compare this to Example 1 (159,445). By paying a 10,000 lump sum two years ago, your current balance is nearly 11,000 lower.

- The “Efficiency” Factor: You paid 10,000, but the balance dropped by more than 10,000 (roughly 11,000). That extra 1,000 reduction is the “interest on interest” you didn’t have to pay. The calculator proves that paying early is always more effective than paying late.

How to Use the Remaining Loan Balance Calculator

The calculator provided above utilizes the Period-by-Period method (Method 2) described above. It is designed to verify manual calculations and simulate complex scenarios involving specific dates and fee structures.

1. Enter Loan Parameters

Input the core details of the loan contract in the primary input fields.

- Loan Principal Amount: Enter the original borrowed sum.

- Interest Rate (%): Input the annual percentage rate.

- Term (Years): Specify the original duration of the loan.

- Loan Start Date: This date is required to align the amortization schedule with the calendar.

2. Set the “As Of” Date

To determine the remaining loan balance for a specific point in time, use the “Calculate Balance As Of” field.

- Entering today’s date provides the current outstanding balance.

- Entering a future date simulates the balance based on the schedule, useful for forecasting payoff amounts.

3. Include Fees (Optional)

If the loan involves specific fee structures, enable the “Loan Fees” section.

- Financed Fees: Enter costs that were added to the loan balance (capitalized) rather than paid upfront. The calculator adds this to the principal.

- Monthly Service Fee: Enter recurring maintenance charges. These are separated from the principal reduction logic to ensure the loan balance calculation remains accurate.

4. Add Extra Payments (Optional)

To calculate loan balance with extra payment inputs, enable the “Extra Payments” section.

- Monthly Extra: Input a recurring additional payment amount and the start date.

- Lump Sum: Input a one-time payment amount and the specific date it is applied.

- The tool will process these inputs sequentially to adjust the remaining balance curve.

5. Review the Analysis

The results section displays the “Current Status Analysis.”

- Remaining Loan Balance (Principal): The calculated debt owed on the selected “As Of” date.

- Total Outstanding: The principal plus any accrued future interest (for reference only).

- Scenario Comparison: A table comparing the standard amortization path against the path with extra payments, highlighting the difference in payoff dates and total cost.

Why Two People With the Same Loan Can Owe Different Amounts

It is a common scenario: Two borrowers take out identical loans from the same lender on the same day. Five years later, they compare notes, and one owes significantly less than the other.

This happens because:

- One borrower makes extra principal payments: Even rounding up a payment by 50 makes a difference over time.

- One borrower pays fees added to the loan: If Borrower A financed their closing costs and Borrower B paid them in cash, Borrower A starts with a higher outstanding principal balance.

- Payment timing differs: If one person pays on the 1st and the other pays on the 15th, the daily interest accrual differs slightly.

- Interest compounding frequency differs: Some loans compound daily, others monthly.

This explains why comparing balances without understanding payment behavior can be misleading. You must look at the specific history of the account.

Remaining Loan Balance vs Similar Loan Terms

When discussing how to calculate remaining loan balance, it is easy to confuse similar-sounding financial terms. Here is a breakdown of the differences.

| Term | What It Represents |

| Remaining Balance | This is the pure unpaid principal only. It does not include future interest or closing fees. This is the number used to calculate the next month’s interest. |

| Payoff Amount | This is the Remaining Balance PLUS any interest accrued since the last payment, plus any administrative closing fees. If closing the loan, this number is required. |

| Total Interest Paid | This is the cumulative cost of borrowing. It is money that has already been paid to the lender. It is distinct from the balance still owed. |

Common Misunderstandings About Loan Balances

When people try to figure out how to calculate remaining loan balance, they often encounter these misconceptions:

- “Most of my payment reduces the loan”: This is incorrect for the early stages. In the first few years of a long-term loan, the majority of the payment covers interest, not the debt.

- “Extra payments change the interest rate”: They do not. The rate remains constant. Extra payments simply reduce the amount of money that the rate is applied to.

- “Balance should halve at mid-term”: On a 30-year loan, the borrower does not owe 50% of the money at Year 15. The balance is likely still 60% or more. The point where half the principal is paid usually occurs much later, often around Year 20 or 21.

Frequently Asked Questions

Beyond this: Critical Calculations You Must Know

Once you understand how to calculate remaining loan balance, broader financial calculations become clearer. This knowledge helps in optimizing debt strategy.

1. How to Calculate Total Interest Paid

This helps in understanding the true cost of the loan. By tracking the loan balance calculation over time, one can sum up exactly how much was paid over the original principal.

2. How to Calculate Real Interest Rate

This adjusts the nominal rate for inflation. It helps in deciding whether to pay off the remaining balance on loan or invest that money elsewhere.

3. How to Calculate Interest Amount Per Month

This explains how each payment is divided. It is simply: Current Balance × Monthly Interest Rate. This simple formula explains why the balance drops so slowly at first.

Summary

The remaining loan balance reflects the true principal still owed at any point in time. It is determined by interest compounding, payment timing, and principal reduction—not by simple subtraction.

The speed at which the balance drops is largely determined by the payment strategy. By understanding how to calculate remaining loan balance with extra payments, it becomes clear that even small additions to the monthly payment can significantly shorten the loan term and save on interest.

Use the calculator provided to verify the “As Of” balance, test a lump sum scenario, or check if a lender’s statement matches the amortization schedule. Knowledge of how to calculate remaining loan balance is the first step toward financial clarity.

Disclaimer

The information provided in this article and via the calculator is for educational purposes only and does not constitute professional financial advice. Always consult with a qualified accountant or financial advisor regarding your specific business situation.