How to calculate total interest paid on a mortgage

A home is likely the most expensive purchase you will ever make, but the price tag on the listing is rarely the true cost.

On paper, a mortgage looks like a simple monthly obligation—a way to split a massive expense into manageable payments over 25 or 30 years. But there is a silent, often overlooked figure accumulating in the background: the total interest. In many cases, if you hold a loan for its full term, the interest alone can cost as much as the house itself.

Banks and lenders know this. They focus your attention on the monthly payment because it feels affordable. They rarely lead with the fact that borrowing $300,000 might eventually cost you $600,000 or more.

Why does this happen? Because of how amortization works. In the early years, the vast majority of your money goes to the bank as profit, not toward paying off your home.

Below, you’ll learn how total mortgage interest is calculated, the formula that drives these numbers, and how to break down real-world examples so you can clearly see the true cost of borrowing—and how different payment strategies change the outcome.

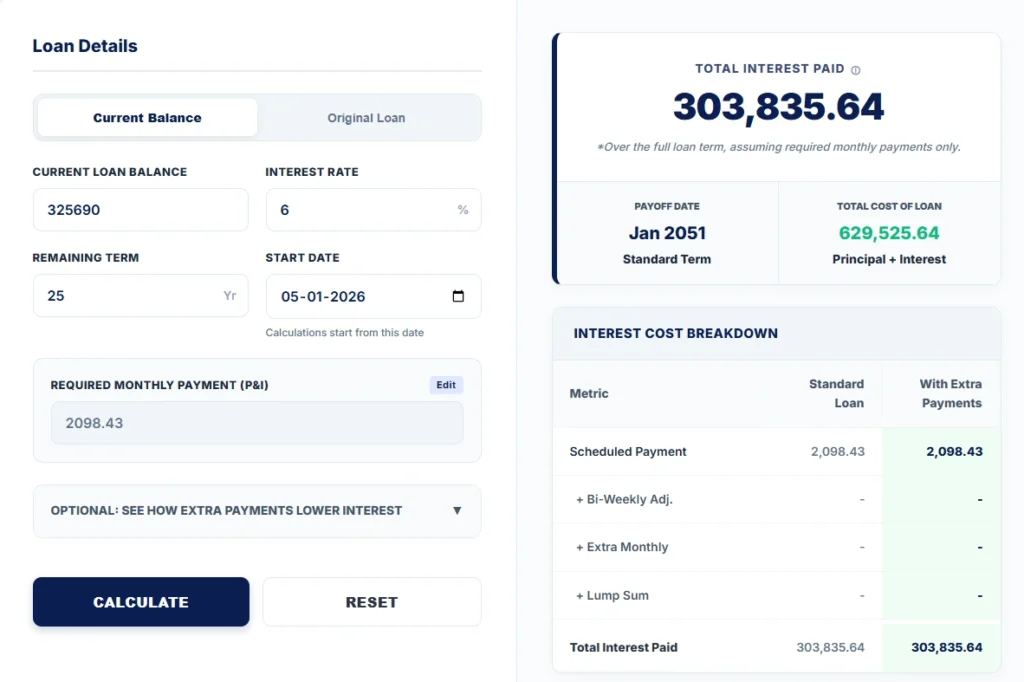

If you don’t want to calculate all of this manually, you can use the mortgage interest paid calculator below to see your total interest instantly.

Mortgage Interest Paid Calculator

Loan Details

- How to calculate total interest paid on a mortgage

- What Is “Total Interest Paid” on a Mortgage?

- Why Total Mortgage Interest Matters

- Mortgage Interest Formula

- What Counts Toward Mortgage Interest (And What Doesn’t)

- Step-by-Step: How to Calculate Total Interest Manually

- Real World Examples

- How to Use Our Mortgage Interest Paid Calculator

- Interpretation Guide: What Your Total Interest Means

- Principal vs. Interest: Why the Early Years Matter

- Common Mistakes When Calculating Mortgage Interest

- Frequently Asked Questions (FAQ)

- Summary

- Beyond This: Calculations That Build on Total Mortgage Interest

- Disclaimer

What Is “Total Interest Paid” on a Mortgage?

Before diving into the math, it is critical to distinguish between your monthly rate and the lifetime cost of the loan.

Total Interest Paid is the cumulative sum of every dollar charged by the lender for the privilege of borrowing money, calculated from your very first payment until the day the loan balance hits zero.

It is not just the interest rate percentage (e.g., 6.5%). It is the actual cash value of that percentage applied to your decreasing balance over hundreds of months.

The Distinction

- Monthly Interest: The cost of borrowing the money for just that specific month. This decreases very slowly over time.

- Total Interest: The aggregate cost over the “life of the loan.” This is the number that often shocks homeowners when they see it written out.

If you borrow money today, you agree to pay back the principal (the amount borrowed) plus the interest. If you calculate total mortgage interest effectively, you can see exactly how much “extra” you are handing over to the bank.

Why Total Mortgage Interest Matters

Many borrowers fixate on getting the lowest interest rate possible. While the rate is important, the total mortgage interest over life of loan is influenced by far more than just that percentage. Understanding this metric is essential for four key reasons:

1. Reveals the True Cost of Borrowing

A “low” monthly payment often masks a massive total cost. By calculating the total interest, you move beyond the “can I afford this monthly payment?” mindset to the “is this loan worth the total cost?” mindset. It exposes the reality that you might be buying one house for yourself and paying for a second one for the bank.

2. Shows the Impact of Loan Term Choices

The difference between a 30-year term and a 15-year term is not just about the monthly cash flow. The longer you hold the money, the more interest you pay. A longer term might save you money monthly but cost you tens of thousands—or even hundreds of thousands—over the long haul.

3. Critical for Early Payoff Decisions

Should you invest your extra cash or pay down your mortgage? You cannot answer that question without knowing how much interest you will save. Calculating the total interest paid on a mortgage allows you to quantify the return on investment (ROI) of making extra payments.

4. Used by Financial Planners & Lenders

Banks use the mortgage interest calculation to assess risk and profitability. Financial planners use it to determine if your debt strategy aligns with your retirement goals. You should use it to ensure you aren’t staying in debt longer than necessary.

Mortgage Interest Formula

There are two ways to look at this math: the complex formula lenders use to determine your payment, and the simpler logic used to find the total interest.

Method 1: Standard Mortgage Formula (Required Payment)

To find your total interest, you first need to know your fixed monthly payment. Lenders use the standard amortization formula:

Monthly Payment (M) = P × [ r × (1 + r)^n ] ÷ [ (1 + r)^n − 1 ]

Where:

• M = Monthly mortgage payment

• P = Principal loan amount

• r = Monthly interest rate (annual rate ÷ 12)

• n = Total number of payments (loan term in years × 12)

While this formula looks intimidating, it simply ensures that your payment stays the same every month while the ratio of principal-to-interest changes inside that payment.

Method 2: How Total Interest Is Calculated

Once you know the monthly payment (M), calculating the total interest is actually quite simple conceptually. You figure out how much cash you will hand the bank over the entire term, and then subtract the amount you actually borrowed.

The Logic:

Total Interest Paid = (Monthly Payment × Total Number of Payments) − Original Loan Amount

Note: This manual calculation works perfectly for fixed-rate mortgages where the payment never changes. However, if you make extra payments or have an adjustable rate, the math becomes complex quickly, which is where a mortgage interest paid calculator becomes necessary.

What Counts Toward Mortgage Interest (And What Doesn’t)

When you look at your monthly bank statement, you usually see one combined amount leaving your account. But that number includes more than just the cost of borrowing. To understand total mortgage interest correctly, you need to separate the loan cost from the ownership costs.

What Is Included in Mortgage Interest

Mortgage interest reflects only the cost of borrowing money from the lender. It includes:

- The interest portion of each monthly payment

This is the amount paid to the lender for using their money. - Interest accrued over time

Interest builds continuously on the remaining loan balance between payments. - Interest on the outstanding balance

Because interest is calculated on what you still owe, reducing the principal lowers future interest costs.

What Is Not Included

Some costs are often bundled into your monthly payment but are not interest. These ownership-related expenses should be excluded when calculating total mortgage interest:

- Property taxes, which are paid to local governments

- Homeowners insurance, which protects the property

- HOA or maintenance fees, common in condos and planned communities

- Closing costs and one-time fees, such as loan origination charges

These expenses may pass through your lender, but they are not part of the interest you pay on the loan itself.

A Common Mistake to Avoid

Simply multiplying your full monthly withdrawal by the loan term will give you the wrong result. To calculate mortgage interest accurately, you must isolate the principal and interest (P&I) portion of the payment and exclude escrowed costs.

Step-by-Step: How to Calculate Total Interest Manually

If you want to audit your loan or just see the numbers for yourself, follow this process.

Step 1: Identify Loan Details

Gather your original loan documents. You need three numbers:

- Principal: (e.g., $400,000)

- Annual Interest Rate: (e.g., 5.0%)

- Loan Term: (e.g., 30 Years)

Step 2: Calculate the Monthly Payment

Using a financial calculator or the formula above, determine the required monthly payment for Principal and Interest only.

- Example: For $400k at 5% over 30 years, the payment is $2,147.29.

Step 3: Multiply by Total Payments

Multiply that monthly payment by the total number of months in your term (30 years × 12 months = 360 months).

- $2,147.29 times 360 = $773,024.40

Step 4: Subtract the Loan Amount

Take the total amount paid (Step 3) and subtract the money you borrowed. The remainder is the cost of the loan.

- $773,024.40 (Total Paid) – $400,000 (Principal) = $373,024.40

Result: In this scenario, the total interest paid is $373,024. You nearly paid for the house twice.

Real World Examples

To really understand how interest works, it helps to look at a loan from two different perspectives: the day you sign the papers, and the day you check your balance years later.

Example A: The Fresh Start (Original Loan)

Imagine you are buying a home today. You are looking at the full picture of what this debt will cost you over the next three decades.

- Loan Amount: $350,000

- Interest Rate: 6.0%

- Term: 30 Years

The Reality: Even though your loan is for $350,000, the bank sets your monthly payment at $2,098.43. By the time you make that final payment in 30 years, you will have paid a total of $405,431.84 in interest alone—more than the cost of the house itself.

Example B: The Check-In (Current Balance)

Now, let’s fast-forward. Suppose you have been paying on that same loan for exactly 5 years. You aren’t starting from scratch anymore; you are managing what’s left.

- Current Balance: $325,690

- Interest Rate: 6.0%

- Remaining Term: 25 Years

The Reality: You have already paid down some principal, but you still have a long road ahead. Based on your remaining balance, the interest you have left to pay is $303,836.

This is why checking your numbers mid-loan is so important: seeing that you still owe over $300k in future interest often motivates homeowners to add a little extra to their monthly payments to bring that number down.

How to Use Our Mortgage Interest Paid Calculator

We have provided a robust tool designed to handle these complex scenarios. Whether you are analyzing a new loan or checking your current mortgage, the tool adapts to your needs.

1. Select Your Mode

- Current Balance: Use this if you are already years into your mortgage. Enter what you owe today and the remaining years.

- Original Loan: Use this if you are shopping for a new home and want to see the full lifetime cost from day one.

2. Enter Loan Details

Input your Balance, Interest Rate, and Remaining Term. The tool will automatically calculate your required monthly payment.

- Note: If your actual payment is different (due to bank rounding or slight rate adjustments), you can click “Edit” to manually override the payment amount for precision.

3. Explore Acceleration Strategies (The “What If”)

This is where you see how much interest will I pay on my mortgage if you change your behavior.

- Bi-Weekly Payments: Toggle this to see the impact of splitting your payment every two weeks (which results in one extra full payment per year).

- Monthly Extra: Enter a recurring amount (e.g., 100) to see how it slashes the interest.

- Lump Sums: Expecting a bonus or inheritance? Add a one-time payment to see how it shifts your payoff date.

4. Analyze the Results

Click “Calculate” to see:

- Total Interest Paid: The headline figure.

- Payoff Date: The exact month you will be debt-free.

- Savings: The precise amount of money kept in your pocket rather than the bank’s.

- Charts: A visual breakdown of Principal vs. Interest.

Interpretation Guide: What Your Total Interest Means

Once you have the number, how do you know if it is “good” or “bad”? Context is everything.

Low Total Interest

(< 50% of Loan Amount)

When total interest stays below half of the loan amount, the borrower typically benefits from a shorter term or low interest rate. This represents a strong and efficient borrowing outcome.

Moderate Total Interest

(50% – 80% of Loan Amount)

This level of interest is common with lower-rate 30-year mortgages or partial early repayments. While costly, it is generally viewed as a reasonable long-term tradeoff.

High Total Interest

(80% – 100% of Loan Amount)

Interest nearing the loan amount usually indicates a long-term mortgage held close to maturity. This is a standard but expensive outcome for many homeowners.

Very High Total Interest

(> 100% of Loan Amount)

When interest exceeds the original loan, the mortgage is operating in a high-rate environment. Small extra payments in this range can significantly reduce both interest and loan duration.Actionable Step: This zone is the most dangerous for long-term wealth. Even small extra payments in this zone yield massive returns. Consider using the mortgage calculator total interest paid tool to find a way to pay just 10% more per month.

Principal vs. Interest: Why the Early Years Matter

To truly understand calculate total mortgage interest, you must understand the “Amortization Curve.”

Mortgage payments are front-loaded with interest. In the first few years of a 30-year loan, roughly 70-80% of your monthly check goes to interest, and only a tiny sliver pays down your debt.

The Timeline:

- Year 1-10: You are mostly paying rent to the bank. The balance drops very slowly.

- Year 11-20: The mix starts to even out.

- Year 21-30: You are finally paying mostly principal.

Why This Matters:

Because interest is calculated on your current balance, every dollar of extra principal you pay in Year 1 is worth far more than a dollar paid in Year 20.

Paying an extra $1,000 in the first year stops that $1,000 from generating interest for the next 29 years. This is why the calculator results change so drastically when you start extra payments early.

Common Mistakes When Calculating Mortgage Interest

When homeowners try to figure out how much interest will I pay on my mortgage, they often fall into these traps.

1. Ignoring the “Life of Loan” Concept

Looking only at the APR is a mistake. A 5% loan over 30 years costs significantly more than a 6% loan over 15 years. You must look at the total dollar amount, not just the rate.

2. Confusing “Bi-Weekly” with “Twice a Month”

True bi-weekly payments mean you pay every 2 weeks (26 payments a year). This equals 13 full monthly payments annually. Simply paying twice a month (24 payments a year) is just standard monthly paying and saves you almost nothing. Our calculator uses the true bi-weekly logic (26 payments).

3. Assuming Tax/Insurance Breaks Down Principal

Many people look at their total bank withdrawal (e.g., $2,500) and multiply it by 360 months. This inevitably yields a wrong, inflated number because it includes taxes and insurance. Interest is only calculated on the loan principal.

4. Forgetting About “Recasting”

If you make a massive lump sum payment, your loan term doesn’t automatically shorten unless you keep paying the original monthly amount. If the bank “recasts” (lowers) your required monthly payment, your interest savings will decrease.

Frequently Asked Questions (FAQ)

Summary

Calculating the total interest on a mortgage is the single best reality check a homeowner can perform. It shifts your focus from “monthly affordability” to “long-term wealth.”

- The Concept: Total interest is the price you pay for the time you hold the money.

- The Formula: (Monthly Payment × Total Months) – Loan Amount.

- The Goal: Minimize this number by shortening the term or making extra payments.

- The Tool: Use the calculator provided to run different scenarios.

Whether you are looking to refinance, buy a new home, or simply get out of debt faster, knowing how to calculate total interest paid on a mortgage puts you in control of your financial future.

Beyond This: Calculations That Build on Total Mortgage Interest

Once you understand how to calculate total interest paid on a mortgage, several related calculations become much easier to interpret. These build on the same core logic and help you analyze your loan more clearly, especially when planning early payoff strategies or reviewing your remaining debt.

How to Pay Off a Mortgage in a Fixed Number of Years

This calculation shows how much you need to pay each month to fully repay your loan within a specific timeframe, such as 15 or 20 years. It directly builds on total interest calculations by revealing how higher payments reduce the overall interest cost.

How to Calculate Paying Off a Mortgage Early

This focuses on how extra monthly payments, biweekly schedules, or lump-sum contributions shorten the loan term. By reducing the balance faster, these strategies significantly lower the total interest paid over the life of the loan.

How to Calculate the Remaining Loan Balance

This calculation tracks how much principal remains unpaid at any point during the loan. It is essential for understanding how much interest is still ahead, planning early repayment, and comparing different payoff scenarios using formulas, examples, and calculators.

Disclaimer

This guide and the accompanying calculator are for educational purposes only. They provide estimates based on standard amortization formulas. Mortgage terms, banking regulations, and interest calculation methods (such as daily vs. monthly accrual) vary by country and lender. Always consult with a qualified financial advisor or mortgage professional before making significant financial decisions.