How to Pay Off a Mortgage in a Fixed Number of Years: Calculate the Required Payment with Formula, Examples, and a Free Calculator

For most homeowners, the mortgage dictates the lifestyle, not the other way around. You sign a contract for 20, 25, or 30 years, and the lender tells you exactly how much to pay every month. While this standard structure works for the bank, it often leaves borrowers paying significantly more interest than necessary over the life of the loan.

However, many borrowers eventually reach a point where they want to change the timeline. You might look at your balance and ask, “What would it take to be debt-free in exactly 10 years?” or “I want to know how to pay off a mortgage before I retire.” When you shift your mindset from “making the minimum payment” to “hitting a specific payoff date,” the math changes completely.

This guide is designed to help you reverse-engineer your loan. Instead of asking how long it will take to pay off your current balance with your current payment, we ask a different question: What is the required payment to pay off mortgage balances in a specific timeframe?

Whether you are looking for how to pay off mortgage in 5 years, 10 years, or any custom duration, this article explains the math behind the strategy. You will learn how required payments are calculated, see practical examples derived directly from the calculator on this page, and learn how to find your exact numbers.

Want a faster answer? Use the calculator below and see exactly what it takes to pay off your mortgage by your chosen year—no math, no guesswork.

Mortgage Target Pay off Calculator

Loan Parameters

Payoff Analysis

- How to Pay Off a Mortgage in a Fixed Number of Years: Calculate the Required Payment with Formula, Examples, and a Free Calculator

- What Does It Mean to Pay Off a Mortgage in a Fixed Number of Years?

- Why the Required Mortgage Payment Increases When You Shorten the Payoff Period

- How Required Mortgage Payments Are Calculated for a Fixed Payoff Period

- Step-by-Step: How to Calculate the Required Payment Manually

- Examples: Paying Off a Mortgage by a Specific Year

- Monthly vs Annual Payments: Choosing the Right Strategy for a Fixed Payoff Goal

- Common Mistakes When Planning to Pay Off a Mortgage Early

- When Paying Off a Mortgage Faster May Not Be Ideal

- How to Use Our Mortgage Target Payoff Calculator

- Standard Mortgage vs Fixed-Year Payoff Plan

- Monthly vs Annual Payment Strategy

- Frequently Asked Questions

- Summary: Turning a Mortgage Into a Time-Bound Goal

- Beyond This: Important Calculations That Build on a Fixed Payoff Strategy

- Disclaimer

What Does It Mean to Pay Off a Mortgage in a Fixed Number of Years?

Paying off a mortgage in a fixed number of years means you are effectively ignoring the original term of your loan contract in favor of a new, self-imposed deadline.

When you first took out your loan, the lender calculated your monthly mortgage payment based on a long horizon—usually decades. This keeps payments lower but maximizes the interest the bank earns. When you decide to target a specific payoff date, you are compressing that timeline.

The Difference Between Original Term and Payoff Goal

Your original loan term is static. If you have a 30-year mortgage and you are 5 years into it, you naturally have 25 years remaining. However, a “fixed payoff goal” is dynamic. It is a choice you make today.

- Original Term: The maximum time the bank allows you to take.

- Payoff Goal: The specific time you want to take (e.g., “I want to know how to pay off home in 5 years“).

Once you set a target—for instance, deciding you want to be mortgage-free in exactly 7 years—the original 25-year schedule becomes irrelevant for your planning. You need a new calculation that treats the loan as if it were a brand-new 7-year mortgage.

Why Set a Fixed Target?

Borrowers rarely choose a random number. This strategy is usually tied to major life events:

- Retirement Planning: Ensuring housing costs disappear before active income stops.

- Education Costs: Freeing up cash flow before children start university.

- Interest Reduction: A shorter term drastically cuts the total interest paid to the lender.

- Financial Freedom: The psychological benefit of owning your home outright.

Understanding how to pay off a mortgage on your own terms requires accurate math, not just guesswork.

Why the Required Mortgage Payment Increases When You Shorten the Payoff Period

If you cut your loan term in half, you might assume your payment doubles. In reality, the math is not that linear. The required payment to pay off mortgage debt early is always higher than your standard payment, but the relationship depends heavily on interest rates.

When you shorten a loan term—for example, looking at a 10-year payoff instead of 20—you are doing two things simultaneously:

- Principal Repayment: You must pay back the same borrowed amount in fewer months.

- Interest Savings: Because the money is borrowed for less time, less interest accumulates.

Because you are paying less total interest, the payment does not always need to double to cut the time in half. However, because mortgage payments in the early years are mostly interest, shifting to a very short-term goal forces a large amount of principal to be paid quickly. This causes a sharp spike in the required monthly cash flow.

The shorter the timeline, the more aggressive the payment curve becomes. This is why paying off a mortgage in a very short period is often a question of cash-flow capacity rather than just desire.

How Required Mortgage Payments Are Calculated for a Fixed Payoff Period

To determine the exact payment needed to pay off a mortgage by a specific year, you cannot simply divide your remaining balance by the number of months. That approach ignores interest entirely and significantly underestimates the true payment. Instead, mortgage calculations rely on amortization formulas that account for the time value of money.

When you use a calculator to determine an early mortgage payoff, the calculation is based on three key variables: the present value of the loan (PV), the periodic interest rate (R), and the total number of payment periods (n).

Required Payment Formula for a Fixed Number of Years

The standard formula used worldwide to calculate a fixed periodic payment is:

P = (PV × R) ÷ [1 − (1 + R)⁻ⁿ]

Where:

- P is the required periodic payment (such as the monthly mortgage payment).

- PV is the present value of the loan, or your current outstanding mortgage balance.

- R is the periodic interest rate. For example, a 6% annual rate paid monthly is converted into a monthly rate.

- n is the total number of payments required to reach your target payoff date.

For example, if your goal is to eliminate your mortgage in five years, n would be 60 monthly payments (5 × 12). The formula calculates the exact payment needed so that the balance reaches zero after the final payment.

Amortization-Based Calculation Method

While the formula above provides the theoretical payment amount, accurate planning requires an amortization-based approach. This is the method used by the calculator on this page.

Instead of relying on a single equation, the calculation builds a complete payment schedule by simulating each period from today until your chosen payoff date. For every payment period, the calculation determines:

- How much interest accrues during the period based on the loan’s rate and payment frequency.

- How much of the payment is applied to interest.

- How much reduces the principal balance.

This step-by-step amortization method produces more reliable results because it reflects real-world mortgage behavior, including lender-specific interest calculations and payment conventions. As a result, when you use a pay off mortgage in 10 years calculator, the results accurately represent the true cost and structure of the loan.

Step-by-Step: How to Calculate the Required Payment Manually

If you want to understand how the numbers work before using a calculator, follow this process to determine the payment needed to pay off your mortgage within a fixed timeframe.

- Determine Your Current Balance

Refer to your most recent loan statement to find the outstanding principal. Do not use the original loan amount—use the balance as of today. - Confirm the Interest Rate

Identify the loan’s nominal annual interest rate. Avoid using the APR if it includes upfront fees or other costs, as those do not affect ongoing interest calculations. - Select a Payment Frequency

Decide whether payments will be made monthly or annually. Most mortgages use monthly payments, though some borrowers plan annual payments using bonuses or lump-sum income. - Set the Payoff Timeline

Choose your target payoff duration (for example, 7 years). Multiply this by your payment frequency to determine the total number of required payments. - Calculate the Required Payment

Use the payment formula or an iterative amortization method to find the payment amount that reduces the balance to zero by the final scheduled payment.

Because this manual approach is time-consuming and error-prone, most borrowers rely on a dedicated pay off mortgage in a fixed number of years calculator to get accurate results instantly.

Examples: Paying Off a Mortgage by a Specific Year

To understand the math behind paying off a mortgage faster, it helps to look at real numbers. The following scenarios use the calculator logic to show exact costs and savings.

Example 1: The Standard 10-Year Payoff Plan

- The Scenario: You have a mortgage balance of $200,000 at 5.00% interest. You want to eliminate this debt in exactly 10 years.

- The Calculation: To clear the balance in 120 months, the calculator determines you need to pay $2,121.31 per month.

- The Outcome: By committing to this fixed amount, your loan hits exactly $0.00 after the 10th year. If you were originally on a slower 25-year schedule (paying ~$1,169), this plan requires a higher monthly commitment but saves you 15 years of interest payments.

Example 2: Monthly vs. Annual Payments (5-Year Goal)

- The Scenario: You want to pay off the same $200,000 balance in 5 years. You are deciding between paying monthly or making one lump sum each year using a business bonus.

- Option A (Monthly): You pay $3,774.25 every month. Total paid over 5 years: $226,455.

- Option B (Annual): You pay $46,343.43 once a year. Total paid over 5 years: $231,717.

- The Difference: The annual strategy costs roughly $5,000 more in total interest. This occurs because the principal balance stays high for 11 months of the year, accruing interest the entire time, whereas monthly payments reduce the balance (and the interest charged) constantly.

Example 3: How Financed Fees Affect the Calculation

- The Scenario: You are refinancing to a 5-year plan. You owe $200,000, but there are $2,000 in closing costs that you roll (finance) into the loan.

- The Calculation: The calculator treats your starting principal as $202,000.

- The Result: Your required monthly payment rises to $3,811.99 (compared to $3,774 without fees).

- Note: If you have separate “Monthly Service Fees” (e.g., $50/month), these are added on top of the principal payment in the “Total Cost” summary, but they do not change the amortization math itself.

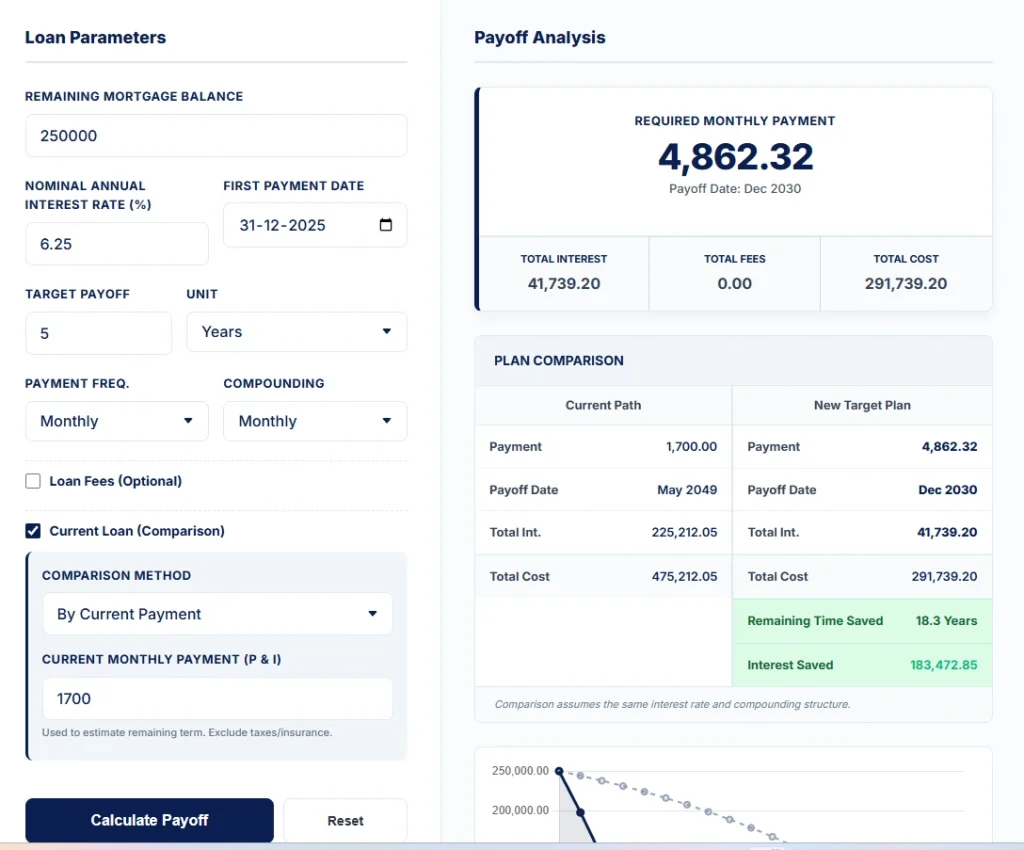

Example 4: Comparison — Accelerating Your Current Habits

- Current Situation: You owe $250,000 at 6.25% interest. You are currently paying $1,700 per month. At this pace, it will take you 23.3 years (until May 2049) to be debt-free.

- The New Goal: You want to be debt-free in exactly 5 years (by Dec 2030).

- The Adjustment: To shorten the timeline, the calculator shows the payment must increase to $4,862.32.

- The Savings: While the monthly cost is significantly higher, this strategy saves 18.3 years of payments and prevents approximately $183,472 in future interest that would have otherwise gone to the bank.

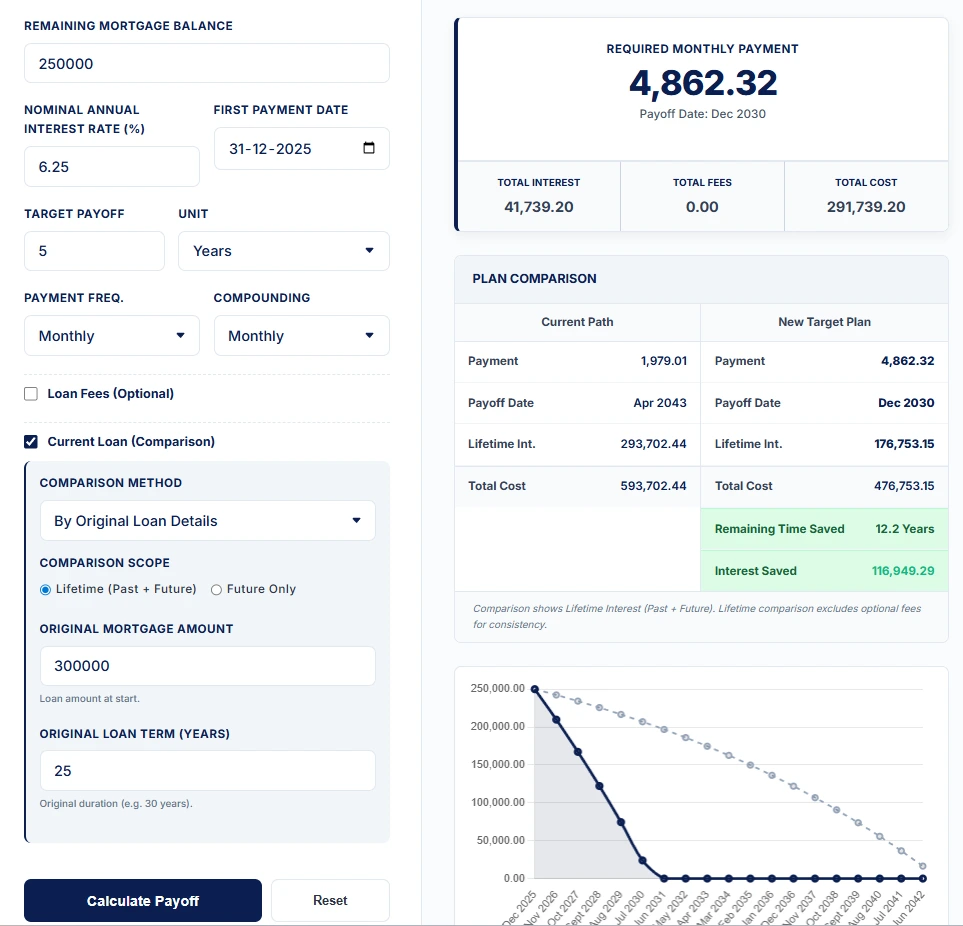

Example 5: Comparison — Beating the Bank’s Schedule

- Original Contract: You originally borrowed $300,000 on a 25-year term. The bank’s required payment is $1,979.

- Current Status: You have paid the balance down to $250,000. If you stick to the bank’s schedule, you still have 17.2 years remaining.

- The New Goal: You want to restructure the remaining balance to finish in exactly 5 years.

- The Adjustment: To eliminate those last 12 years, your payment needs to rise to $4,862.32.

- The Savings: This adjustment saves 12.2 years of time. More importantly, checking the “Lifetime” comparison scope reveals that this plan reduces your total lifetime interest cost by $116,949 compared to the original 25-year contract.

Monthly vs Annual Payments: Choosing the Right Strategy for a Fixed Payoff Goal

When you use the calculator, you will see options for payment frequency. This choice impacts your cash flow strategy.

Monthly Payments:

This is the standard approach. It aligns with how most people receive their salary. If you are calculating how to pay off home in 5 years, a monthly target helps you budget strictly. It requires consistent discipline every 30 days.

Annual Payments:

Some borrowers prefer to make minimum payments all year and then make a massive lump sum reduction using an annual bonus or business dividend. A yearly mortgage payment strategy is effective but risky; if you spend the money before the payment date, you fall behind on your goal.

Common Mistakes When Planning to Pay Off a Mortgage Early

Even with the best intentions, borrowers often miscalculate how to pay off a mortgage. Here are the most common pitfalls:

- Simple Division: You cannot calculate how to pay off mortgage in 5 years by dividing your balance by 60. That ignores the 5% (or higher) interest compounding against you. You will fall short of the goal.

- Ignoring Prepayment Penalties: Some fixed-rate mortgages charge a fee if you pay off the loan too quickly. Always check your contract before setting an aggressive goal like how to pay off house in your desired number of years.

- Forgetting Taxes and Insurance: The calculator determines the Principal and Interest payment. In many countries, banks also collect property taxes and insurance (Escrow). You must add these costs on top of the calculated result to know your total cash outflow.

- Over-Optimism: Committing to pay off mortgage in X years calculator results is easy on paper. In reality, locking yourself into a high monthly payment leaves less room for emergencies.

When Paying Off a Mortgage Faster May Not Be Ideal

While learning how to pay off your mortgage in X years is a noble financial goal, it is not always the mathematically best choice.

If your mortgage interest rate is very low (e.g., 2-3%), and you can earn 7-8% in the stock market or a retirement fund, you might lose money by paying off the debt early. The money you use to pay down the cheap debt could have grown faster elsewhere.

Additionally, liquidity matters. Equity in a house is “dead money”—you cannot spend it to buy groceries or handle a medical emergency unless you sell the house or borrow against it again. Before you pour all your cash into learning how to pay off a mortgage in X years, ensure you have a solid emergency fund.

How to Use Our Mortgage Target Payoff Calculator

We have developed a specific tool on this page to help you solve how to pay off a mortgage with precision. It includes features for fees, comparison scopes, and unit selection that generic calculators miss.

Step 1: Enter Loan Details

Start in the “Loan Parameters” section.

- Remaining Mortgage Balance: Enter exactly what you owe today.

- Nominal Annual Interest Rate: Enter your rate (e.g., 6.25).

- First Payment Date: This defaults to next month, but you can adjust it to start planning for the future.

Step 2: Set the Target Payoff Duration

This is the most critical step for users asking how to pay off your mortgage in 5 years.

- Target Payoff: Enter the number (e.g., 5).

- Unit: Select “Years” or “Months”.

- If you want to know how to pay off mortgage in 5 to 7 years, you can test “5 Years” and then switch to “7 Years” to see the difference.

Step 3: Select Payment and Compounding Frequency

- Payment Freq: Choose “Monthly” for a standard monthly mortgage payment or “Annual” for a lump-sum approach.

- Compounding: Check your loan agreement. The tool defaults to “Monthly”, but supports “Semi-Annual” (common in Canada/UK) and “Annual”.

Step 4: Add Optional Fees

Toggle the “Loan Fees (Optional)” section if applicable.

- Financed Fees: Costs added to your loan balance (like Example 3 above). This increases the Principal the calculator uses.

- Upfront/Monthly Fees: Enter any service charges here. This ensures your “Total Cost” is accurate, though these do not change the P&I payment itself.

Step 5: Compare Against an Existing Loan Scenario

To see the true value of your plan, toggle “Current Loan (Comparison)”.

You can compare your new plan against:

- By Current Payment: Enter what you currently pay (P&I). The tool will calculate when you would have finished versus your new target date.

- By Original Loan Details: Enter your original loan amount and term (e.g., 30 years).

- Scope: You can choose to compare “Lifetime” (Past + Future) costs or “Future Only”. This is vital for seeing how much interest you will save from today onwards.

Step 6: Interpret the Results

The “Payoff Analysis” section updates automatically.

- Required Payment: This is the magic number. It is the exact amount you must pay to hit your target.

- Savings: Look for the green text. This shows the interest and time you save by adopting this new plan.

- Chart: The visual graph shows two lines—your current slow path and your new fast path. The gap between them represents your saved time.

Results Interpretation Guide

When you see the results, the numbers can be shocking. For example, the required payment to pay off mortgage balances in 5 years is often double or triple the standard payment.

Do not be discouraged. Use the result as a benchmark. If pay off mortgage in X years calculator shows a payment of $4,000 and you can only afford $3,000, simply adjust the target to 7 or 8 years. Find the “sweet spot” where the payment is affordable, but the interest savings are still significant.

Also, pay attention to the “Total Cost” comparison. Sometimes, paying off a loan extremely fast (like 2 years) saves very little extra interest compared to 4 years, but puts massive strain on your wallet. Use the tool to find the balance.

Standard Mortgage vs Fixed-Year Payoff Plan

| Feature | Standard Mortgage | Fixed-Year Payoff Plan |

| Term Definition | Set by Lender (e.g., 30 Years) | Defined by Borrower (e.g., 5, 10 Years) |

| Primary Goal | Lowest monthly obligation | Debt-free by a specific target date |

| Interest Cost | Maximum possible interest | Significantly reduced interest |

| Payment Amount | Lower, easier on cash flow | Higher, requires budgeting discipline |

| Flexibility | Limited | High (you choose the target) |

Monthly vs Annual Payment Strategy

| Aspect | Monthly Payments | Annual Payments |

| Cash Flow | Spread evenly throughout the year | Large lump-sum once per year |

| Interest Exposure | Lower (balance drops monthly) | Higher (balance stays high for 11 months) |

| Planning Effort | Automated and simple | Requires holding cash without spending it |

| Best Suited For | Salaried employees | Business owners or bonus-reliant workers |

Frequently Asked Questions

Summary: Turning a Mortgage Into a Time-Bound Goal

Learning how to pay off a mortgage in a fixed timeframe is one of the most empowering financial steps a homeowner can take. It shifts the power dynamic from the lender to you. Instead of paying indefinitely, you are paying with a purpose.

Whether your goal is aggressive—like learning how to pay off your mortgage in 5 years—or moderate, like aiming for a 15-year finish line, the math remains the same. The key is to calculate the required payment to pay off mortgage balances accurately, ensuring you account for interest, fees, and compounding.

Use the calculator on this page to experiment. Try a 5-year target. Then try a 10-year target. See how the monthly mortgage payment shifts and find the strategy that fits your budget while maximizing your freedom.

Beyond This: Important Calculations That Build on a Fixed Payoff Strategy

Once you understand how to pay off a mortgage within a fixed number of years, several other key financial calculations become much easier to interpret. These calculations help you evaluate the true cost of your loan and make informed decisions about accelerating payoff or managing debt more efficiently.

1. How to Calculate Total Interest Paid

This calculation shows the full cost of borrowing over time. By tracking all payments made and comparing them to the original principal, you can determine exactly how much interest the loan costs over its lifetime.

2. How to Calculate the Real Interest Rate

The real interest rate adjusts the stated (nominal) rate for inflation. This perspective helps you decide whether it is financially smarter to pay off the mortgage early or use excess funds for investing or other opportunities.

3. How to Calculate Interest Percentage on a Loan

This calculation helps you understand how interest is applied to your loan balance and how the rate translates into actual interest costs. It breaks down the relationship between the stated interest rate, the loan balance, and the interest charged over time, using clear formulas and practical examples.

4. How to Calculate the Remaining Loan Balance

This calculation tracks how much principal is still unpaid after each payment. It is the foundation for payoff planning, early repayment strategies, refinancing analysis, and comparing different payoff timelines.

Disclaimer

This content and the accompanying calculator are for educational and informational purposes only. They do not constitute financial advice, and the results are estimates based on the inputs provided. Mortgage terms, prepayment penalties, and specific banking regulations vary by country and lender. Always consult with a qualified financial advisor or your mortgage lender before making significant changes to your repayment strategy.